Dow Futures Fall: Moody's Downgrade Impacts Dollar And Markets

Table of Contents

Moody's Downgrade: The Catalyst for Dow Futures Fall

Moody's decision to downgrade the US government's credit rating from AAA to Aa1 is a significant event with far-reaching consequences. Their rationale centers around the deterioration of the US government's fiscal strength, characterized by rising debt levels and persistent political gridlock hindering meaningful fiscal reforms. This downgrade signals a diminished confidence in the US government's ability to manage its debt effectively.

- Specific Downgrade: The downgrade from AAA to Aa1 represents a significant loss of creditworthiness, signaling increased risk associated with US government bonds.

- Implications for Borrowing Costs: The downgrade is likely to lead to higher borrowing costs for the US government, as lenders will demand higher yields to compensate for the increased perceived risk. This will further strain the already burdened federal budget.

- Market Reaction: The immediate market reaction to the downgrade was swift and negative, with Dow futures experiencing a substantial drop reflecting investor uncertainty and risk aversion.

Impact on Dow Futures and Stock Market Volatility

The fall in Dow futures is a direct consequence of Moody's downgrade. The decreased confidence in the US government's fiscal health translates into a broader lack of confidence in the US economy, leading investors to reduce their exposure to riskier assets.

- Correlation Between Downgrade and Dow Futures Fall: The correlation is clear: the perceived increase in risk associated with the US economy directly impacted investor sentiment, leading to a sell-off and a decline in Dow futures.

- Ripple Effects on Other Indices: The impact extends beyond Dow futures. Other major US stock market indices, such as the S&P 500 and Nasdaq, also experienced significant declines, reflecting the widespread concern triggered by the downgrade.

- Market Volatility: The news led to increased market volatility, as investors grapple with the implications of the downgrade and its potential long-term effects. Trading volumes surged as investors reacted decisively to the changing market conditions.

- Data Support: Initial reports show Dow futures falling by [insert percentage change here] following the announcement, with trading volume significantly exceeding average daily levels.

Dollar Depreciation and Global Market Reactions

The downgrade's impact extends beyond the US stock market, significantly affecting the value of the US dollar. The diminished confidence in the US government's fiscal responsibility weakens the dollar's appeal as a reserve currency.

- Relationship Between Creditworthiness and Dollar Strength: A strong US dollar is typically associated with a high level of confidence in the US economy and its creditworthiness. The downgrade undermines this confidence, leading to a weakening dollar.

- Impact on International Trade and Investment: A weaker dollar can impact international trade, making US exports more competitive but also potentially increasing the cost of imports. Foreign investment in US assets may also decrease.

- Global Market Reactions: Global markets, particularly in Europe and Asia, reacted negatively to the news, reflecting the interconnectedness of the global financial system and the potential for the downgrade to trigger broader economic uncertainty.

Safe-Haven Assets and Investor Sentiment

The uncertainty created by the Moody's downgrade has led to a shift in investor sentiment towards safe-haven assets.

- Seeking Safety: Investors are moving funds from riskier assets into safer options, seeking to protect their investments during this period of economic uncertainty.

- Price Movements of Safe-Haven Assets: The prices of gold and government bonds, typical safe-haven assets, have risen as investors flock to these perceived secure investments.

- Implications for Long-Term Investment Strategies: The downgrade necessitates a reassessment of long-term investment strategies, with investors potentially adjusting their portfolios to reflect the heightened risk environment.

Conclusion

Moody's downgrade of the US credit rating has triggered a significant fall in Dow futures, weakened the US dollar, and increased global market volatility. The event underscores the importance of fiscal responsibility and the interconnected nature of the global financial system. Understanding the factors influencing Dow futures falls is crucial for navigating the current market uncertainty. The impact on Dow futures falls requires close monitoring, and investors must adapt their strategies accordingly. Stay informed on the latest developments impacting Dow futures and navigate the market effectively. Subscribe to reputable financial news sources to stay updated on the evolving situation and the continuing implications of this momentous event.

Featured Posts

-

Find The Answers Nyt Mini Crossword April 2nd

May 20, 2025

Find The Answers Nyt Mini Crossword April 2nd

May 20, 2025 -

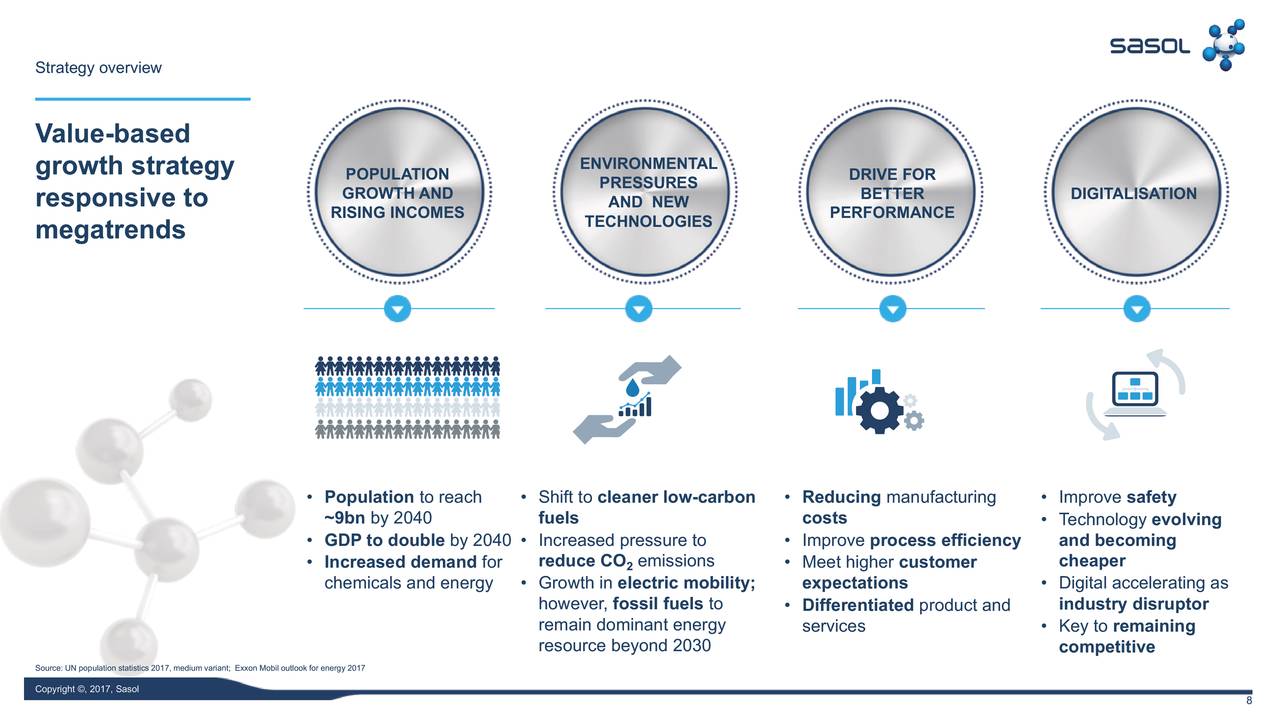

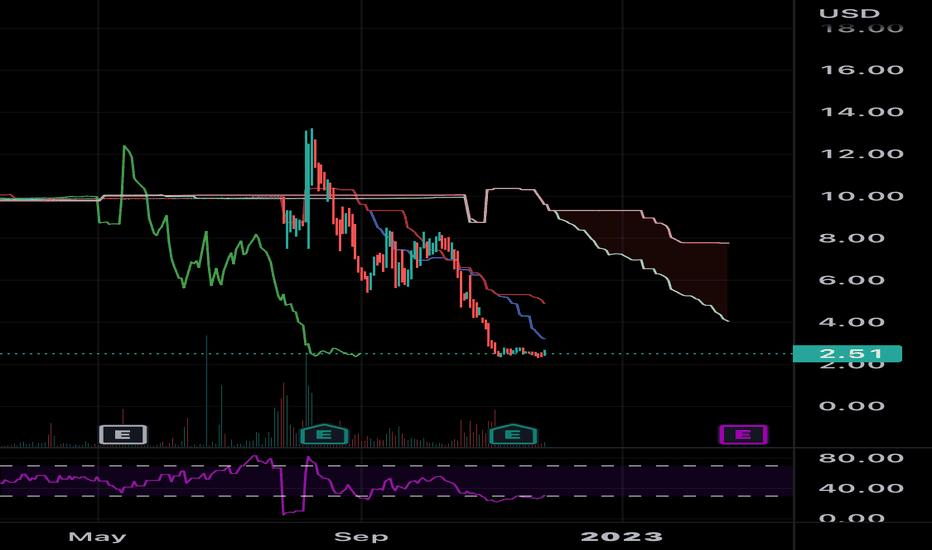

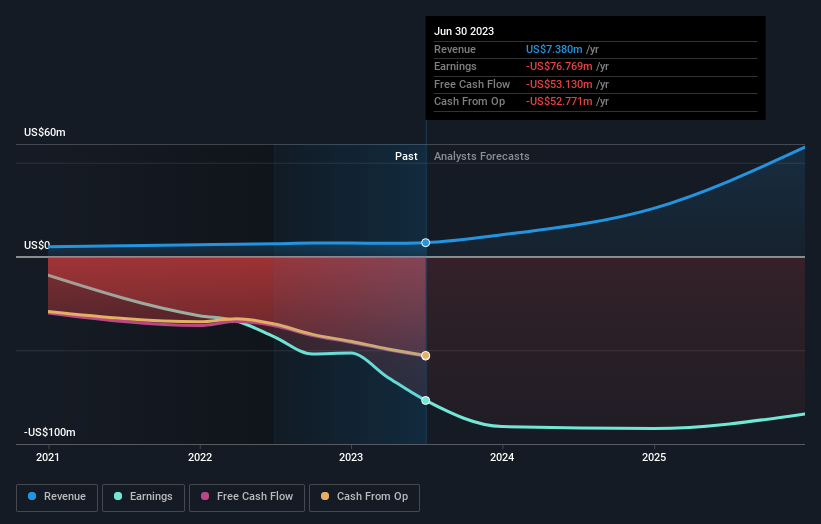

Sasol Sol Investor Concerns After Two Year Strategy Silence

May 20, 2025

Sasol Sol Investor Concerns After Two Year Strategy Silence

May 20, 2025 -

The Rise Of Femicide Exploring The Factors Contributing To Increased Incidents

May 20, 2025

The Rise Of Femicide Exploring The Factors Contributing To Increased Incidents

May 20, 2025 -

Robert Pattinson And Suki Waterhouses Public Display Of Affection In Nyc The Batman 2 Connection

May 20, 2025

Robert Pattinson And Suki Waterhouses Public Display Of Affection In Nyc The Batman 2 Connection

May 20, 2025 -

Former Munster Prop James Cronin Leads Highfield

May 20, 2025

Former Munster Prop James Cronin Leads Highfield

May 20, 2025

Latest Posts

-

Understanding The Monday Rise In D Wave Quantum Inc Qbts Stock

May 20, 2025

Understanding The Monday Rise In D Wave Quantum Inc Qbts Stock

May 20, 2025 -

Thursdays Market Activity And Its Impact On D Wave Quantum Qbts Stock

May 20, 2025

Thursdays Market Activity And Its Impact On D Wave Quantum Qbts Stock

May 20, 2025 -

Understanding The Factors Behind D Wave Quantum Qbts Stocks Thursday Drop

May 20, 2025

Understanding The Factors Behind D Wave Quantum Qbts Stocks Thursday Drop

May 20, 2025 -

1 Reason To Buy This Ai Quantum Computing Stock During A Market Dip

May 20, 2025

1 Reason To Buy This Ai Quantum Computing Stock During A Market Dip

May 20, 2025 -

Factors Contributing To D Wave Quantum Inc Qbts Stocks Monday Increase

May 20, 2025

Factors Contributing To D Wave Quantum Inc Qbts Stocks Monday Increase

May 20, 2025