Dow Jones' Gradual Rise: Positive PMI Data Provides Support

Table of Contents

Understanding the Purchasing Managers' Index (PMI) and its Influence on the Dow Jones

The Purchasing Managers' Index (PMI) is a crucial economic indicator reflecting the prevailing direction of economic trends. Calculated monthly by surveying purchasing managers in various sectors, the PMI provides insights into business activity, future economic prospects, and the overall health of the economy. There are various PMI indices, including manufacturing PMI and services PMI, each offering a specific perspective. A higher PMI generally indicates expansion, while a lower PMI suggests contraction.

The relevance of the PMI to the Dow Jones is significant. A positive PMI, signaling strong manufacturing and service sector activity, usually boosts investor confidence. This confidence translates into increased investment in the stock market, driving up the Dow Jones.

- PMI reflects business activity and future economic prospects.

- Strong PMI suggests increased manufacturing and service sector activity, which contributes to higher corporate earnings.

- Rising PMI often correlates with increased corporate earnings expectations, leading to higher stock valuations.

- Different PMI indices (manufacturing, services, construction) provide a holistic view of the economy's health.

Recent Positive PMI Data and its Impact on Market Sentiment

Recent PMI data released by the Institute for Supply Management (ISM) has been overwhelmingly positive. For instance, the July manufacturing PMI registered a strong reading of [Insert actual recent data here], exceeding expectations and signaling robust growth in the sector. Similarly, the services PMI showed [Insert actual recent data here], further reinforcing the positive economic outlook.

This positive data has significantly impacted market sentiment. Investors are feeling more optimistic about the future prospects of US businesses, leading to increased buying activity and pushing the Dow Jones upward. Many analysts attribute the Dow Jones' gradual rise directly to this improved economic sentiment fueled by strong PMI figures.

- Specific PMI numbers for relevant sectors (e.g., manufacturing, services): [Insert specific data with sources]

- Comparison to previous periods (showing improvement): [Insert comparative data with sources showcasing improvement]

- Quotes from market analysts interpreting the data: “[Insert relevant quotes from reputable financial analysts]”

Other Factors Contributing to the Dow Jones' Gradual Rise

While positive PMI data plays a significant role in the Dow Jones' gradual rise, it's not the sole driving force. Other factors contribute to the overall market performance. These include:

- Interest rate decisions: The Federal Reserve's monetary policy significantly influences investor sentiment. Lower interest rates generally stimulate economic activity and boost stock prices.

- Geopolitical events: Global events, such as international trade agreements or geopolitical tensions, can impact investor confidence and market volatility.

- Technological advancements: Innovation in technology sectors represented in the Dow Jones often fuels growth and attracts investment.

- Consumer spending: Strong consumer spending indicates a healthy economy, which supports corporate earnings and positively impacts the stock market.

Analyzing the Sustainability of the Dow Jones' Current Trajectory

While the current positive trend is encouraging, it's crucial to acknowledge potential risks and uncertainties. Several factors could potentially impact the Dow Jones' future performance:

- Potential economic headwinds: Unexpected inflation spikes, supply chain disruptions, or a slowdown in consumer spending could dampen economic growth and negatively affect the stock market.

- Geopolitical risks: Escalating international tensions or unforeseen global events could introduce market volatility.

- Predictions for future PMI data and its potential impact: While current PMI data is positive, future readings are crucial to maintain the upward trajectory. Any significant decline in PMI could reverse the current trend.

Conclusion: The Dow Jones' Gradual Rise: A Positive Outlook Supported by PMI Data

In conclusion, the Dow Jones' gradual rise demonstrates a strong correlation with positive PMI data. This positive economic indicator, coupled with other contributing factors, indicates a relatively healthy US economy and fuels investor confidence. However, maintaining this upward trend hinges on continued positive PMI readings and the absence of significant economic headwinds or geopolitical shocks. Regularly monitoring PMI data and other key economic indicators is essential for understanding market dynamics and making informed investment decisions. Stay updated on the Dow Jones' gradual rise by regularly checking our analysis of PMI data and other crucial economic indicators. Understanding the interplay between these factors is vital for navigating the complexities of the stock market.

Featured Posts

-

Draper Claims First Atp Masters 1000 Title At Indian Wells

May 24, 2025

Draper Claims First Atp Masters 1000 Title At Indian Wells

May 24, 2025 -

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025 -

Applying For Bbc Radio 1 Big Weekend Tickets A Practical Guide

May 24, 2025

Applying For Bbc Radio 1 Big Weekend Tickets A Practical Guide

May 24, 2025 -

Le Pens Support Base Assessing The National Rallys Sunday Demonstration

May 24, 2025

Le Pens Support Base Assessing The National Rallys Sunday Demonstration

May 24, 2025

Latest Posts

-

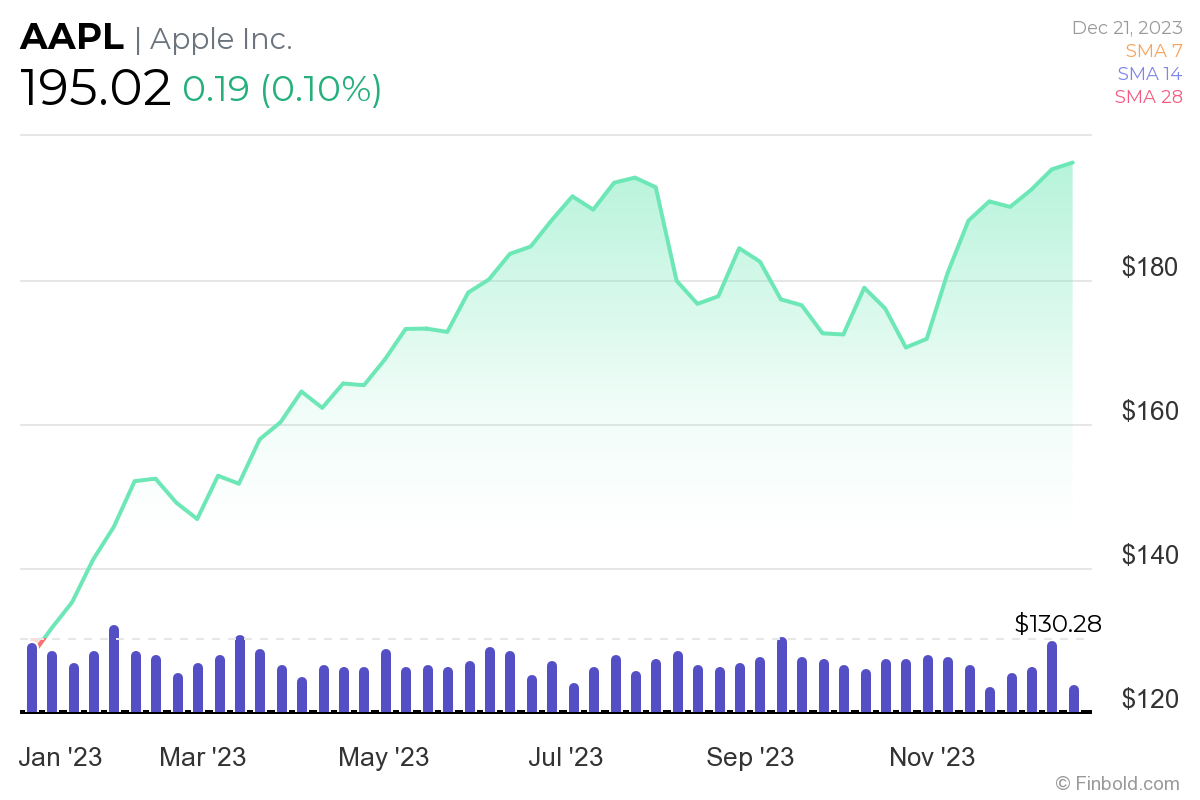

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025 -

17 Celebrities Who Destroyed Their Careers Overnight

May 24, 2025

17 Celebrities Who Destroyed Their Careers Overnight

May 24, 2025 -

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025 -

Apple Stock 200 Entry Point Considering A 254 Potential

May 24, 2025

Apple Stock 200 Entry Point Considering A 254 Potential

May 24, 2025 -

Resurfaced Allegations Sean Penns Public Support Of Woody Allen Fuels Controversy

May 24, 2025

Resurfaced Allegations Sean Penns Public Support Of Woody Allen Fuels Controversy

May 24, 2025