Federal Student Loan Refinancing: Everything You Need To Know

Table of Contents

Who Qualifies for Federal Student Loan Refinancing?

Before diving into the benefits, it's crucial to understand who qualifies for federal student loan refinancing. Unlike federal student loan consolidation, which is handled directly by the government, refinancing involves a private lender. This means eligibility hinges on your creditworthiness. Lenders assess your application based on several factors:

- Credit Score: A good credit score is typically required, usually 670 or higher, though some lenders may accept lower scores with higher interest rates or stricter terms. A higher score often translates to better interest rates and loan terms.

- Debt-to-Income Ratio (DTI): Lenders examine your DTI ratio – the percentage of your monthly income going towards debt payments. A lower DTI generally improves your chances of approval.

- Income: Lenders need to verify your income to assess your ability to repay the loan. Stable employment history is usually a prerequisite.

- Type of Federal Loans: While most federal student loans (like Direct Subsidized and Unsubsidized Loans, Grad PLUS Loans, and Federal Stafford Loans) are eligible for refinancing, it's crucial to confirm with the lender which specific loan types they accept.

Specific Programs & Lenders:

Different lenders have varying requirements. Some may cater specifically to borrowers with excellent credit scores, offering the most competitive rates. Others may have programs designed for those with less-than-perfect credit, although expect higher interest rates in these cases.

Bullet Points:

- Minimum credit score requirements vary by lender (typically 660-700 or higher).

- Debt-to-income ratios are typically considered, with lower ratios increasing approval chances.

- Direct Loans (Subsidized, Unsubsidized, PLUS) are commonly refinanced, but check lender eligibility specifics.

- Income verification involves providing pay stubs, tax returns, or bank statements.

The Benefits of Federal Student Loan Refinancing

Refinancing your federal student loans can unlock several significant advantages:

- Lower Interest Rates: This is the most attractive benefit. By securing a lower interest rate than your current federal loans, you can significantly reduce the overall cost of your debt over the loan's lifespan. This translates to thousands of dollars in savings.

- Lower Monthly Payments: A lower interest rate often leads to a lower monthly payment, making your debt more manageable. This can improve your overall financial health and reduce monthly stress.

- Shorter Repayment Term: While a shorter repayment term means higher monthly payments, you can pay off your debt faster, saving on overall interest.

- Tax Benefits: While not directly tied to refinancing itself, the interest paid on certain student loans might be tax deductible. Consult a tax professional for personalized advice.

- Loan Consolidation: Refinancing typically consolidates multiple federal student loans into a single, streamlined payment, simplifying the repayment process.

Bullet Points:

- Potential savings on interest: thousands of dollars over the loan's lifespan.

- Reduced monthly payments: freeing up cash flow for other financial priorities.

- Faster loan payoff: achieving financial freedom sooner.

- Simplified repayment process: one payment instead of multiple.

The Risks and Drawbacks of Federal Student Loan Refinancing

While refinancing offers potential advantages, it's essential to acknowledge the risks:

- Loss of Federal Student Loan Benefits: The most significant drawback is losing access to federal student loan benefits like income-driven repayment plans (IDR), deferment, and forbearance. These are crucial safety nets for borrowers who experience financial hardship.

- Early Repayment Penalties: Some lenders may charge penalties for early repayment. Carefully review the terms and conditions before signing.

- Higher Interest Rates (if not carefully shopped around): Failing to compare offers from multiple lenders could lead to higher interest rates than your current federal loans. Thorough research is vital.

- Private Lender Risks: Private lenders are not subject to the same regulations as the federal government, increasing the risk of unforeseen fees or less consumer protection.

- Impact on Credit Score: The application process itself can temporarily impact your credit score, although this is usually temporary.

Bullet Points:

- Loss of federal protections like IDR plans, deferment, and forbearance.

- Potential for higher interest rates than your current loans if you don't shop around.

- Temporary negative impact on credit score during the application process.

- Risk of hidden fees or less consumer protection compared to federal loans.

How to Find the Best Federal Student Loan Refinancing Options

Finding the best refinancing option requires diligent research and comparison:

- Compare Interest Rates and Terms: Don't settle for the first offer. Use online comparison tools and contact multiple lenders to find the best rates and terms for your situation.

- Check Lender Reviews and Reputation: Read online reviews to gauge the lender's customer service, transparency, and overall reputation. Look for lenders with a strong track record.

- Consider Lender Factors: Evaluate factors like customer service responsiveness, available online tools, and any associated fees beyond interest.

- Understand the Application Process: Each lender has a specific application process. Familiarize yourself with the requirements and the necessary documentation.

Bullet Points:

- Use online comparison tools to find the best rates and terms.

- Read reviews to assess lender reputation and customer service.

- Consider factors like fees, online tools, and customer service.

- Gather necessary documents (pay stubs, tax returns, etc.) before applying.

Federal Student Loan Refinancing vs. Federal Consolidation

It's crucial to differentiate between refinancing and federal loan consolidation:

- Consolidation: Combines multiple federal student loans into a single loan with the same federal government. It often simplifies payments but doesn't typically lower your interest rate.

- Refinancing: Involves replacing your federal loans with a new private loan, potentially lowering your interest rate but sacrificing federal protections.

| Feature | Refinancing | Consolidation (Federal) |

|---|---|---|

| Lender | Private lender | Federal government |

| Interest Rate | Potentially lower | Usually the weighted average of existing loans |

| Federal Benefits | Lost | Retained |

| Loan Terms | More flexible | Less flexible |

Bullet Points:

- Refinancing can lower interest rates; consolidation usually doesn't.

- Refinancing offers more flexible repayment terms; consolidation offers less.

- Federal benefits are lost with refinancing but retained with consolidation.

Conclusion: Making Informed Decisions About Federal Student Loan Refinancing

Federal student loan refinancing can be a powerful tool for managing student loan debt, but it's not a one-size-fits-all solution. Weighing the potential benefits (lower interest rates, reduced monthly payments) against the risks (loss of federal protections) is crucial. Careful research, comparison shopping, and potentially seeking professional financial advice are essential steps before making a decision. Start exploring your federal student loan refinancing options today and find the best solution to manage your student loan debt effectively!

Featured Posts

-

Save With Uber One Free Deliveries And Exclusive Discounts In Kenya

May 17, 2025

Save With Uber One Free Deliveries And Exclusive Discounts In Kenya

May 17, 2025 -

May 16 Oil Market Report News And In Depth Analysis

May 17, 2025

May 16 Oil Market Report News And In Depth Analysis

May 17, 2025 -

The Knicks Resurgence Thibodeaus Successful Adaptation And Improved Results

May 17, 2025

The Knicks Resurgence Thibodeaus Successful Adaptation And Improved Results

May 17, 2025 -

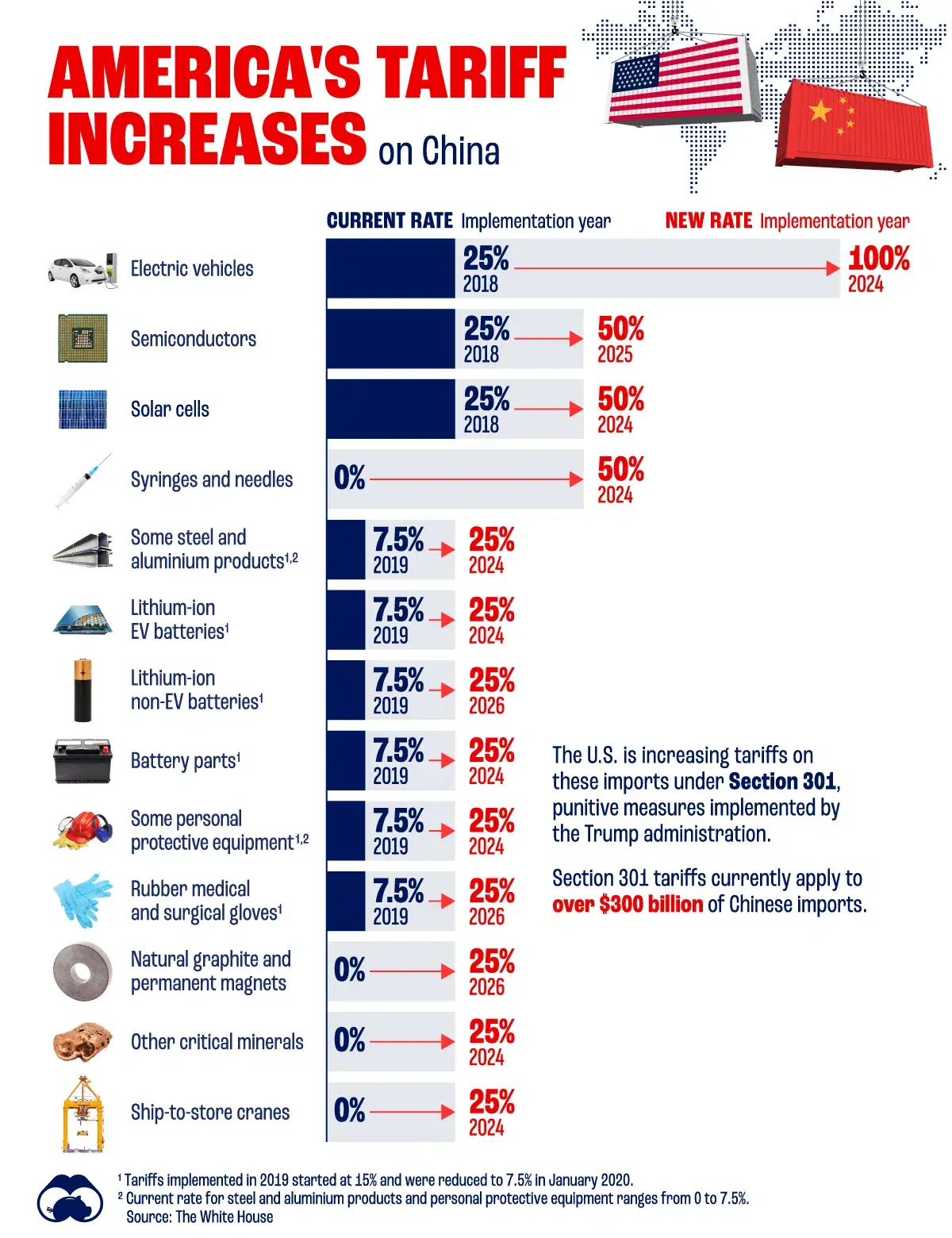

Canadas Tariff Cuts On Us Products Exemptions And Their Economic Impact

May 17, 2025

Canadas Tariff Cuts On Us Products Exemptions And Their Economic Impact

May 17, 2025 -

Government Crackdown On Delinquent Student Loan Borrowers What You Need To Know

May 17, 2025

Government Crackdown On Delinquent Student Loan Borrowers What You Need To Know

May 17, 2025

Latest Posts

-

Real Money Online Casinos New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025

Real Money Online Casinos New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025 -

Could These Etfs Profit From Ubers Autonomous Vehicle Technology

May 17, 2025

Could These Etfs Profit From Ubers Autonomous Vehicle Technology

May 17, 2025 -

7 Bit Casino Leading The Pack Of Top Online Casinos In New Zealand

May 17, 2025

7 Bit Casino Leading The Pack Of Top Online Casinos In New Zealand

May 17, 2025 -

Guide To Traveling With Pets On Uber In Mumbai

May 17, 2025

Guide To Traveling With Pets On Uber In Mumbai

May 17, 2025 -

Betting On Ubers Driverless Future Etfs That Could Pay Off

May 17, 2025

Betting On Ubers Driverless Future Etfs That Could Pay Off

May 17, 2025