IRS Data To Be Used For Immigration Enforcement: Judge's Ruling

Table of Contents

H2: The Judge's Ruling and its Legal Basis

The court's decision, while not yet publicly available in its entirety as of this writing, reportedly allows the IRS to share certain taxpayer data with ICE under specific circumstances. The exact parameters of what constitutes "acceptable" data sharing remain unclear, leading to widespread anxiety. This lack of transparency further fuels the controversy.

- Citation of the case: (Insert case citation once available)

- Summary of the judge's reasoning: The judge's reasoning, based on preliminary information, appears to center on the argument that such data sharing is permissible under existing law and serves legitimate government interests related to national security and immigration enforcement.

- Relevant legal precedents mentioned in the ruling: (Insert relevant legal precedents once available)

- Specific statutes or laws that the judge cited: (Insert specific statutes and laws once available)

H2: Concerns Regarding Privacy and Data Security

The potential for misuse of taxpayer data under this ruling is deeply troubling. The risks extend far beyond simple data breaches, encompassing a range of serious concerns:

- Potential for discriminatory targeting: Critics argue that this ruling could lead to the discriminatory targeting of specific racial or ethnic groups, exacerbating existing inequalities within the immigration system. The lack of clear guidelines increases the risk of biased application of this data sharing.

- Vulnerability to data breaches and leaks: Sharing sensitive taxpayer information with another agency significantly increases the potential for data breaches and leaks, exposing individuals to identity theft and other forms of fraud. The IRS's own history of security vulnerabilities further heightens these concerns.

- Erosion of public trust in government institutions: This ruling severely undermines public trust in government institutions, particularly the IRS, which is charged with protecting the confidentiality of taxpayer information.

- Lack of transparency and accountability mechanisms: The lack of transparency surrounding the specifics of the data-sharing agreement raises concerns about the absence of sufficient accountability mechanisms to prevent abuse.

- Violation of taxpayer rights and expectations of confidentiality: Many argue this ruling violates the implicit and explicit promises of confidentiality made to taxpayers.

H2: Reactions from Advocacy Groups and Government Officials

The ruling has been met with a firestorm of criticism from numerous advocacy groups and government officials.

- Statements from civil rights organizations: The ACLU and other civil rights organizations have strongly condemned the ruling, citing concerns about potential discrimination and violations of privacy rights.

- Statements from government officials (pro and con): (Insert statements from relevant government officials once available) Expect diverse opinions, ranging from strong support for increased immigration enforcement to fierce condemnation of the privacy implications.

- Public opinion polls or surveys (if available): (Insert data from public opinion polls or surveys once available)

- Congressional actions or proposed legislation in response: (Include details on any Congressional actions or proposed legislation once available)

H3: The Role of ICE and DHS in the Data Sharing Process

ICE and DHS will utilize the shared IRS data to bolster immigration enforcement efforts. The specifics of the data sharing protocols and oversight mechanisms remain largely undisclosed, raising further concerns.

- Description of the data sharing protocols between the IRS, ICE, and DHS: (Insert details of protocols once available)

- Existing oversight mechanisms to prevent abuse: (Describe existing oversight mechanisms, or the lack thereof, once available)

- Potential limitations or restrictions on the use of the data: (Specify any limitations or restrictions once available)

H2: Long-Term Implications and Future of Taxpayer Data Protection

This ruling has profound implications for the future of taxpayer data protection and the relationship between citizens and their government.

- Impact on future IRS data sharing agreements: This ruling sets a precedent that could embolden other agencies to request similar data sharing arrangements, potentially compromising sensitive taxpayer information across various sectors.

- Potential changes to taxpayer privacy legislation: Expect intense pressure on Congress to revise existing legislation to better protect taxpayer privacy in the wake of this decision.

- Effects on public trust in tax compliance: The ruling could erode public trust in the tax system, impacting voluntary compliance.

- Broader implications for data privacy in other government agencies: This case highlights broader concerns about data privacy across all government agencies and the need for stronger protections.

3. Conclusion:

This article examined the recent court ruling allowing the IRS to share data with ICE for immigration enforcement, highlighting the significant privacy concerns raised by this decision. The ruling has sparked widespread debate among advocacy groups, government officials, and the public, raising questions about the balance between national security and the protection of taxpayer information. The long-term implications of this decision remain uncertain, but it underscores the urgent need for robust data protection measures and increased transparency regarding the use of sensitive taxpayer information.

Call to Action: Stay informed about the ongoing developments regarding the use of IRS data for immigration enforcement and advocate for stronger protections of taxpayer privacy. Contact your elected officials and demand greater transparency and accountability in the use of IRS data. Learn more about your rights as a taxpayer and how to protect your information. #IRSData #ImmigrationEnforcement #TaxpayerPrivacy #DataPrivacy

Featured Posts

-

Nba Draft Lottery Sixers Odds Viewing Information And Key Details

May 13, 2025

Nba Draft Lottery Sixers Odds Viewing Information And Key Details

May 13, 2025 -

Gibraltar Industries Rock Earnings Preview What To Expect

May 13, 2025

Gibraltar Industries Rock Earnings Preview What To Expect

May 13, 2025 -

Amazon Doom Dark Ages Xbox Controller Sale Limited Edition

May 13, 2025

Amazon Doom Dark Ages Xbox Controller Sale Limited Edition

May 13, 2025 -

Examining Uk And Australian Hypocrisy Regarding Myanmars Military And Opposition

May 13, 2025

Examining Uk And Australian Hypocrisy Regarding Myanmars Military And Opposition

May 13, 2025 -

Visiting Kanika House A Journey Through The Drafting Of Indias Constitution

May 13, 2025

Visiting Kanika House A Journey Through The Drafting Of Indias Constitution

May 13, 2025

Latest Posts

-

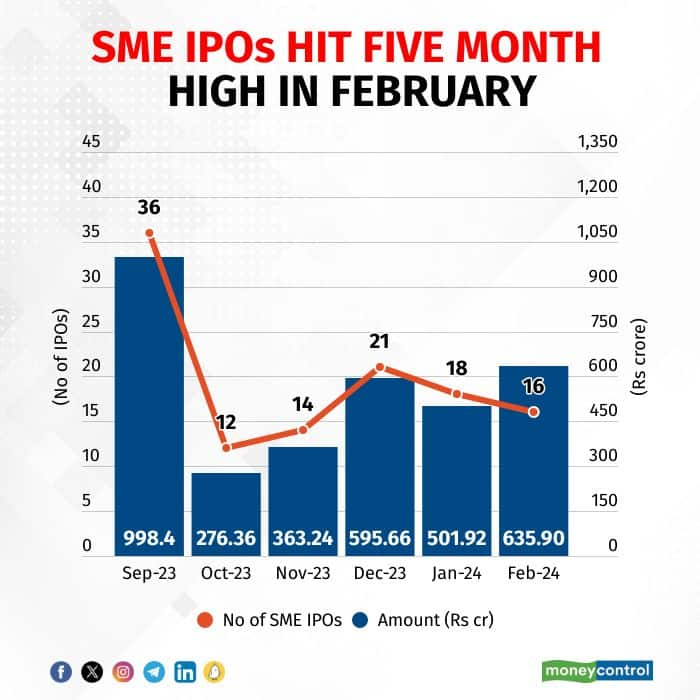

The Impact Of Tariffs On Ipo Activity A Comprehensive Analysis Of The Current Market Situation

May 14, 2025

The Impact Of Tariffs On Ipo Activity A Comprehensive Analysis Of The Current Market Situation

May 14, 2025 -

Market Volatility And The Freeze On Ipos Analyzing The Effects Of Tariffs

May 14, 2025

Market Volatility And The Freeze On Ipos Analyzing The Effects Of Tariffs

May 14, 2025 -

Nyse Parent Ices Q1 Earnings Surpass Estimates Driven By Robust Trading Activity

May 14, 2025

Nyse Parent Ices Q1 Earnings Surpass Estimates Driven By Robust Trading Activity

May 14, 2025 -

Ice Parent Nyse Exceeds Q1 Profit Expectations On Strong Trading Volume

May 14, 2025

Ice Parent Nyse Exceeds Q1 Profit Expectations On Strong Trading Volume

May 14, 2025 -

Beyond The Ipo A Forerunners Guide To Long Term Startup Success

May 14, 2025

Beyond The Ipo A Forerunners Guide To Long Term Startup Success

May 14, 2025