Is Refinancing Federal Student Loans With A Private Lender Right For You?

Table of Contents

Understanding Federal vs. Private Student Loans

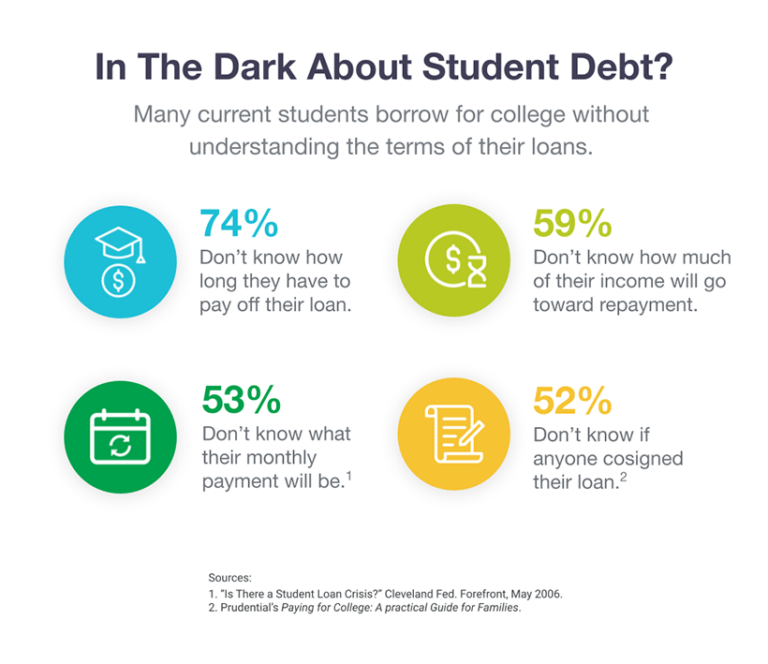

Before diving into the complexities of refinancing, it's essential to understand the core differences between federal and private student loans. Federal student loans offer several crucial protections and benefits unavailable with private loans. These benefits include:

- Government protections: Federal loans are backed by the government, offering safeguards against default and various repayment options.

- Flexible repayment options: Federal loans often provide income-driven repayment plans, adjusting payments based on your income and family size. This includes plans like Income-Driven Repayment (IDR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR).

- Potential for loan forgiveness programs: Federal loan borrowers may qualify for loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), after making 120 qualifying monthly payments.

Refinancing your federal student loans with a private lender means forfeiting these valuable protections and benefits. Once you refinance, you lose access to income-driven repayment plans and federal loan forgiveness programs. This is a significant trade-off that demands careful consideration.

When Refinancing Federal Student Loans Might Make Sense

While losing federal benefits is a considerable drawback, refinancing federal student loans might make sense under specific circumstances. This is particularly true for borrowers with:

- Excellent credit scores: A high credit score significantly improves your chances of securing a lower interest rate with a private lender, potentially saving you substantial money over the life of the loan.

- Stable income: Lenders prefer borrowers with a proven history of consistent income, making it easier to qualify for favorable terms.

- Multiple loans: Refinancing can simplify your repayment process by consolidating multiple loans into a single, manageable monthly payment.

However, even in these scenarios, you must carefully compare rates and terms from multiple private lenders before making a decision. A seemingly lower interest rate might be offset by higher fees or less favorable repayment terms. Always focus on the total cost of the loan over its lifespan, not just the monthly payment. Remember that a lower monthly payment often comes with a longer repayment period, potentially leading to paying more in interest overall.

Potential Downsides of Refinancing Federal Student Loans

Refinancing your federal student loans involves inherent risks. The most significant downside is the loss of the federal protections and benefits already discussed. This includes:

- Loss of income-driven repayment plans: If your income decreases unexpectedly, you'll lose the flexibility of adjusting your payments with an income-driven repayment plan.

- Loss of loan forgiveness programs: Opportunities for loan forgiveness, such as PSLF, disappear after refinancing.

- Increased risk during financial hardship: Without the safeguards of federal loans, you’ll be solely reliant on the private lender's policies during financial hardship, which may be less lenient.

- Negative impact on your credit score: Missed payments on a private student loan will negatively impact your credit score, making it harder to secure loans or credit in the future. This is different from federal loans, which have more forgiving default processes.

How to Choose the Right Private Lender for Refinancing

Choosing the right private lender is crucial for a successful refinancing experience. Thorough research is key. This involves:

- Comparing rates and fees: Don't just focus on the interest rate. Compare all fees, including origination fees, prepayment penalties, and late payment fees.

- Checking lender reviews and ratings: Look at independent reviews and ratings from reputable sources to assess the lender's reputation and customer service. Sites like the Better Business Bureau can be helpful.

- Understanding the loan terms: Carefully review the loan agreement, including the interest rate, repayment period, and any other conditions.

- Considering customer service: Choose a lender with responsive and helpful customer service. You'll want easy access to support if any issues arise.

Step-by-Step Guide to Refinancing Federal Student Loans

Refinancing your federal student loans involves several steps. Follow this guide for a smooth process:

- Check your credit score: A higher credit score leads to better loan terms.

- Shop around for the best rates: Compare offers from multiple lenders. Use online comparison tools to streamline this process.

- Gather necessary documents: Prepare documents like your tax returns, pay stubs, and student loan details.

- Complete the application process: Fill out the application accurately and completely.

- Understand the terms and conditions: Carefully review the loan agreement before signing.

Making the Right Decision on Refinancing Federal Student Loans

Refinancing federal student loans can offer advantages, such as lower interest rates and simplified payments. However, it’s vital to fully understand the associated risks, including the loss of crucial federal protections and benefits. Careful comparison shopping and a thorough understanding of your financial situation are essential before making this significant decision. Weigh the pros and cons carefully. Explore your federal student loan refinancing options and research private lenders thoroughly before committing to refinancing your federal student loans. Should you refinance federal student loans? Only you can answer that question after careful consideration of all the relevant information.

Featured Posts

-

Angel Reese Supports Brothers Ncaa Win With Heartfelt Mothers Day Tribute

May 17, 2025

Angel Reese Supports Brothers Ncaa Win With Heartfelt Mothers Day Tribute

May 17, 2025 -

When To Refinance Federal Student Loans And When Not To

May 17, 2025

When To Refinance Federal Student Loans And When Not To

May 17, 2025 -

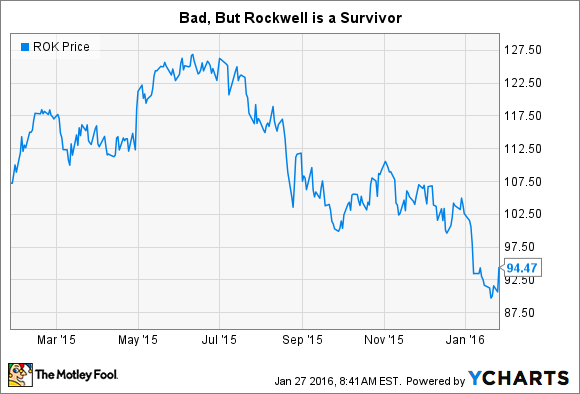

Rockwell Automation Earnings Surprise Stock Surge And Market Movers

May 17, 2025

Rockwell Automation Earnings Surprise Stock Surge And Market Movers

May 17, 2025 -

Exclusive Potential Shift In Covid 19 Vaccine Recommendations Under Rfk Jr S Hhs

May 17, 2025

Exclusive Potential Shift In Covid 19 Vaccine Recommendations Under Rfk Jr S Hhs

May 17, 2025 -

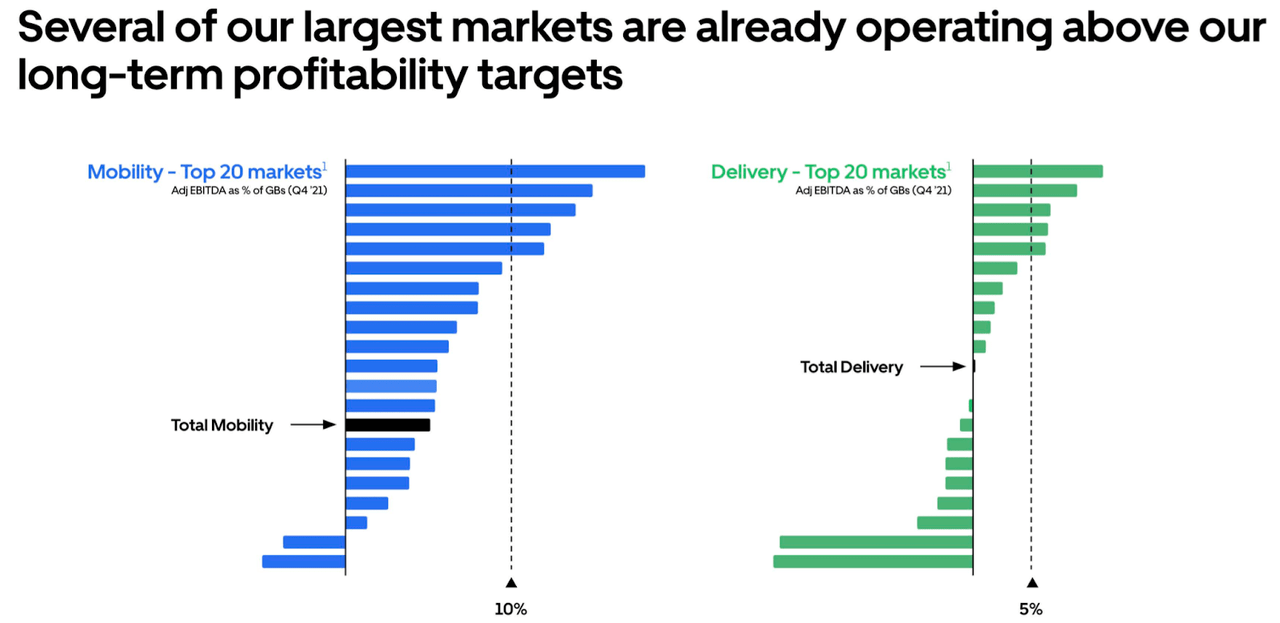

Why Did Uber Stock Jump Over 10 In April

May 17, 2025

Why Did Uber Stock Jump Over 10 In April

May 17, 2025

Latest Posts

-

Fortnite Cowboy Bebop Bundle Price And Details For Faye Valentine And Spike Spiegel Skins

May 17, 2025

Fortnite Cowboy Bebop Bundle Price And Details For Faye Valentine And Spike Spiegel Skins

May 17, 2025 -

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skin Bundle Price Check

May 17, 2025

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skin Bundle Price Check

May 17, 2025 -

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025 -

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025 -

Fortnite The Return Of Beloved Skins After 1000 Days In The Item Shop

May 17, 2025

Fortnite The Return Of Beloved Skins After 1000 Days In The Item Shop

May 17, 2025