Magnificent Seven Stocks: $2.5 Trillion In Lost Market Value This Year

Table of Contents

Main Points: Dissecting the $2.5 Trillion Loss

The decline of the Magnificent Seven is not a single event but a confluence of macroeconomic headwinds and company-specific challenges. Let's delve into the key contributing factors:

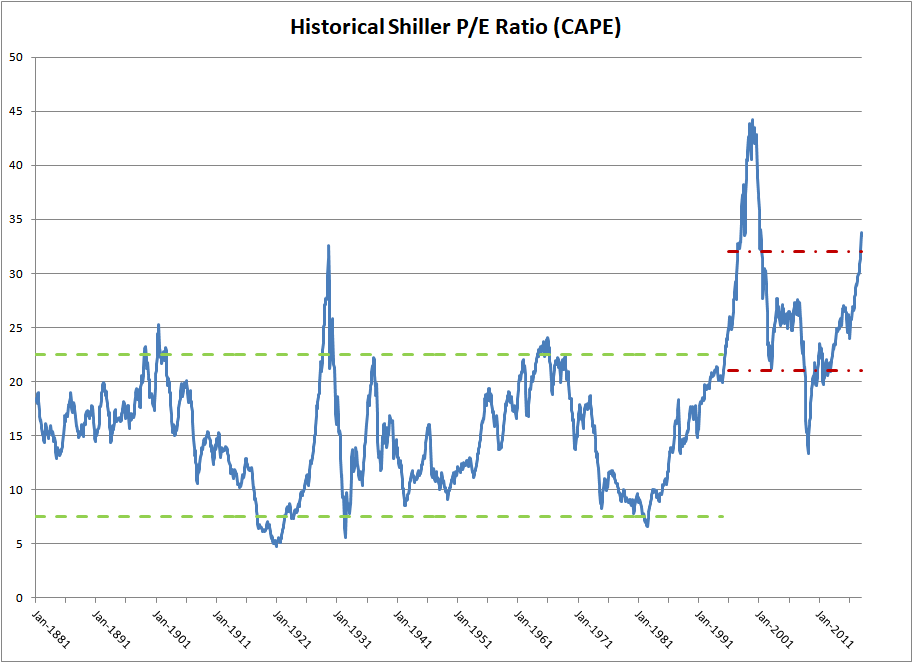

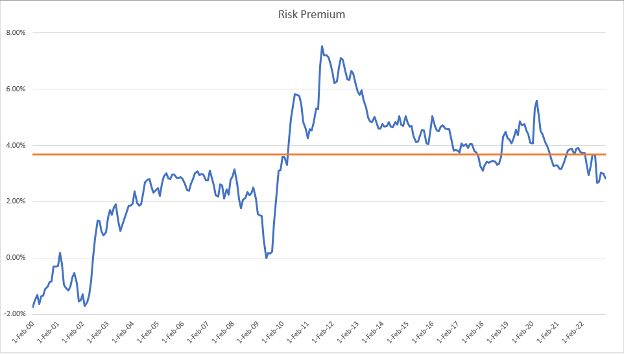

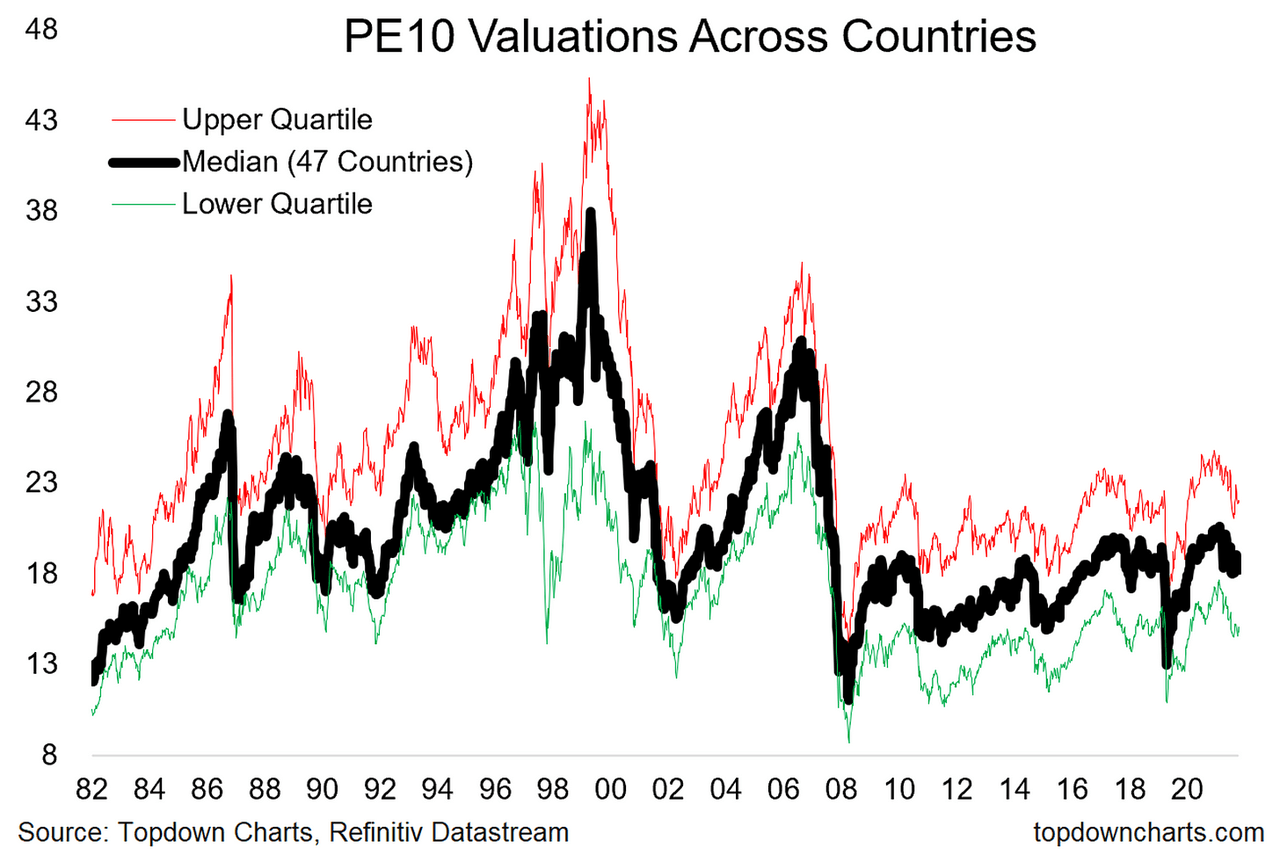

2.1. The Impact of Rising Interest Rates on Magnificent Seven Stocks

The inverse relationship between interest rates and tech stock valuations is well-established. Higher interest rates increase the cost of borrowing, making it more expensive for tech companies to fund expansion, research and development, and acquisitions. This directly impacts future earnings projections. Furthermore, rising rates increase the discount rate used in valuation models, reducing the present value of future cash flows and thus lowering stock prices.

- Higher borrowing costs: Tech companies, particularly those in the growth phase, rely heavily on debt financing. Increased interest rates make this debt more expensive, squeezing profit margins and slowing down growth.

- Impact on investor appetite: Investors are less inclined to invest in high-growth, long-term investments when safer, fixed-income assets offer higher returns due to rising interest rates. This shift in investor preference reduces demand for Magnificent Seven Stocks.

- Shift towards dividend-paying stocks: As interest rates rise, investors often seek more stable, dividend-paying stocks, further reducing the appeal of high-growth tech stocks that prioritize reinvesting profits over dividends.

2.2. Inflation's Bite: Eroding Consumer Spending and Tech Demand

Rampant inflation has significantly impacted consumer spending, directly affecting demand for tech products and services. Reduced disposable income means consumers are less likely to purchase discretionary items like new electronics, software subscriptions, or cloud-based services.

- Reduced discretionary spending: Inflation eats into consumer budgets, forcing them to prioritize essential goods and services over non-essential tech purchases.

- Impact on cloud computing: Businesses, facing budget constraints due to inflation, may delay or reduce cloud computing adoption, impacting the revenue of companies like Amazon Web Services (AWS).

- Slowing advertising revenue: Inflation impacts advertising budgets, negatively affecting the advertising revenue streams of Meta and Alphabet, which heavily rely on digital advertising.

2.3. Geopolitical Uncertainty and Supply Chain Disruptions

Geopolitical instability and ongoing supply chain disruptions have added significant pressure on the tech sector. The war in Ukraine, trade tensions with China, and semiconductor chip shortages have all contributed to increased production costs and delivery delays.

- Geopolitical risks: The war in Ukraine and ongoing tensions with China create uncertainty in global markets, impacting investor confidence and investment decisions regarding the Magnificent Seven Stocks.

- Semiconductor shortages: The ongoing shortage of semiconductor chips impacts the production of various tech products, leading to delays and increased costs.

- Supply chain complexities: Navigating the complexities of global supply chains has become more expensive and challenging, further impacting profitability.

2.4. Regulatory Scrutiny and Antitrust Concerns

Increased regulatory scrutiny and antitrust concerns pose significant risks to the Magnificent Seven. Concerns about market dominance and potential monopolistic practices have led to investigations and potential lawsuits, impacting investor confidence and valuations.

- Antitrust investigations: Ongoing investigations and potential antitrust lawsuits could lead to significant fines, structural changes, or even breakups of these tech giants.

- Regulatory uncertainty: The uncertainty surrounding future regulatory actions creates a chilling effect on investment and innovation within these companies.

- Potential divestitures: Regulatory pressure may force the Magnificent Seven to divest certain assets or businesses, impacting their overall market capitalization.

Conclusion: Navigating the Future of the Magnificent Seven Stocks

The $2.5 trillion loss in market value of the Magnificent Seven Stocks is a result of a complex interplay of rising interest rates, inflation, geopolitical uncertainty, and regulatory scrutiny. While a recovery is possible, continued risks remain. Understanding these complexities is crucial for navigating the current market volatility. Stay informed and conduct thorough research before making any investment decisions related to these companies or the broader tech sector. The future performance of the Magnificent Seven Stocks remains uncertain, requiring investors to carefully consider the ongoing challenges and potential opportunities. Careful analysis of the Magnificent Seven Stocks, along with a diversified investment strategy, is vital in today's dynamic market.

Featured Posts

-

Malaysias Data Center Expansion Focus On Negeri Sembilan

Apr 29, 2025

Malaysias Data Center Expansion Focus On Negeri Sembilan

Apr 29, 2025 -

Facing Google Perplexity Ceos Vision For The Future Of Ai Browsers

Apr 29, 2025

Facing Google Perplexity Ceos Vision For The Future Of Ai Browsers

Apr 29, 2025 -

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025 -

Jurassic Parks Jeff Goldblum A London Fan Frenzy

Apr 29, 2025

Jurassic Parks Jeff Goldblum A London Fan Frenzy

Apr 29, 2025 -

Pw C Faces One Year Ban From Saudi Arabias Wealth Fund

Apr 29, 2025

Pw C Faces One Year Ban From Saudi Arabias Wealth Fund

Apr 29, 2025

Latest Posts

-

Elevated Stock Market Valuations Why Bof A Remains Confident

May 12, 2025

Elevated Stock Market Valuations Why Bof A Remains Confident

May 12, 2025 -

High Stock Valuations Bof As View And Investor Implications

May 12, 2025

High Stock Valuations Bof As View And Investor Implications

May 12, 2025 -

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

May 12, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

May 12, 2025 -

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025 -

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025