Net Asset Value (NAV) Of Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's assets after deducting its liabilities. For ETFs, this is calculated by taking the total market value of all the underlying assets held within the ETF (like stocks, bonds, or other securities), subtracting any liabilities (like management fees or expenses), and then dividing the result by the total number of outstanding shares. This calculation provides a per-share value reflecting the intrinsic worth of the ETF.

The NAV is crucial for several reasons:

- Investment Decisions: The NAV helps determine if an ETF is trading at a premium or discount to its actual value. This is particularly important when buying or selling ETFs.

- Performance Assessment: Tracking NAV changes over time allows investors to gauge the ETF's performance and compare it to its benchmark index (in this case, the Dow Jones Industrial Average). A rising NAV typically indicates positive performance.

- Underlying Asset Performance: Changes in the NAV directly reflect the overall performance of the underlying assets within the ETF. If the Dow Jones Industrial Average performs well, the Amundi Dow Jones Industrial Average UCITS ETF NAV will likely increase.

- NAV vs. Market Price: It's vital to understand that the NAV and the market price of an ETF can differ slightly. The market price fluctuates throughout the trading day based on supply and demand, while the NAV is calculated at the end of the trading day.

How to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward through several reliable sources:

- Amundi's Official Website: Check the dedicated ETF page on Amundi's website. Look for a section providing historical and current NAV data. This is often the most reliable source.

- Major Financial News Websites: Sites like Bloomberg, Yahoo Finance, and Google Finance usually list ETF NAV information. Search for the ETF's ticker symbol (this information can be found on Amundi's website) to locate the NAV data.

- Your Brokerage Platform: Most brokerage accounts display the NAV alongside other key information for ETFs held in your portfolio.

Important Considerations:

- Date and Time: Always note the date and time the NAV was calculated. NAVs are typically calculated at the close of the market.

- Reporting Lag: There might be a slight delay between the market close and the official reporting of the NAV.

Interpreting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding how to interpret the NAV is key to using it effectively.

- Dow Jones Industrial Average Correlation: The Amundi Dow Jones Industrial Average UCITS ETF aims to track the Dow Jones Industrial Average. Therefore, fluctuations in the NAV generally reflect changes in the index's performance. A rising index means a rising NAV, and vice versa.

- Tracking Growth/Decline: Regularly monitoring the NAV over time reveals the ETF’s growth or decline. This helps assess long-term performance and identify trends.

- NAV and Share Price Relationship: While NAV and market price are usually close, they can diverge slightly due to market forces. Understanding this difference is essential for making informed buy/sell decisions.

- Factors Affecting NAV Fluctuations: Several factors can influence NAV fluctuations, including:

- Overall market trends (bull or bear markets).

- Economic conditions (interest rates, inflation, etc.).

- Performance of individual companies within the Dow Jones Industrial Average.

Using NAV to Make Informed Investment Decisions

The NAV is a critical tool for making informed investment decisions.

- Buy/Sell Decisions: Comparing the current NAV to your purchase price helps determine profit or loss. It also allows you to assess whether the ETF is trading at a discount or premium.

- Comparison with Other Metrics: Consider the NAV alongside other essential metrics like the expense ratio (management fees) and dividend yield to get a comprehensive picture of the ETF’s value and potential returns.

- Portfolio Diversification: NAV helps in assessing the contribution of the Amundi Dow Jones Industrial Average UCITS ETF to your overall portfolio diversification strategy.

- Benchmarking Performance: Tracking the NAV allows you to evaluate the ETF's performance against its benchmark (the Dow Jones Industrial Average) and other similar ETFs.

Conclusion: Mastering the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for successful investing. By regularly checking the NAV from reliable sources and comparing it to other relevant metrics, investors can make well-informed buy/sell decisions, track performance, and optimize their investment strategy. Stay informed about the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF to optimize your investment strategy.

Featured Posts

-

Silence Impose La Chine Et La Repression Des Voix Discordantes En France

May 24, 2025

Silence Impose La Chine Et La Repression Des Voix Discordantes En France

May 24, 2025 -

Joy Crookes Carmen Song Review And Analysis

May 24, 2025

Joy Crookes Carmen Song Review And Analysis

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025 -

Us Band Teases Glastonbury Appearance Official Confirmation Awaited

May 24, 2025

Us Band Teases Glastonbury Appearance Official Confirmation Awaited

May 24, 2025 -

New Matt Maltese Album Her In Deep Exploring Themes Of Intimacy And Growth

May 24, 2025

New Matt Maltese Album Her In Deep Exploring Themes Of Intimacy And Growth

May 24, 2025

Latest Posts

-

Ar Ai

May 24, 2025

Ar Ai

May 24, 2025 -

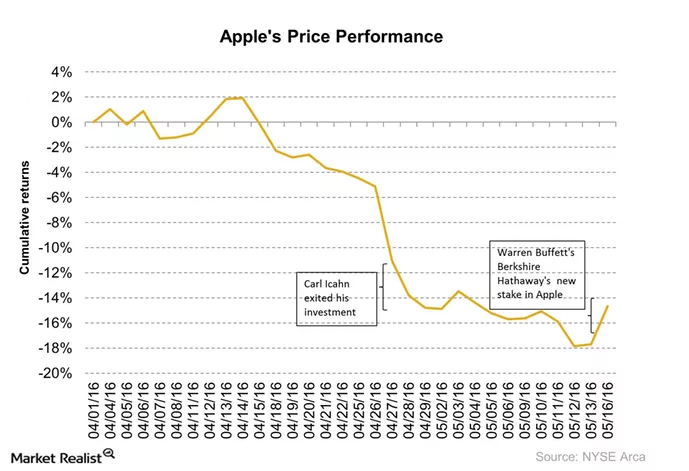

Understanding Berkshire Hathaways Apple Strategy After Buffetts Departure

May 24, 2025

Understanding Berkshire Hathaways Apple Strategy After Buffetts Departure

May 24, 2025 -

The Future Of Berkshire Hathaways Apple Investment Under New Leadership

May 24, 2025

The Future Of Berkshire Hathaways Apple Investment Under New Leadership

May 24, 2025 -

Berkshire Hathaways Apple Stock Assessing The Impact Of Buffetts Succession

May 24, 2025

Berkshire Hathaways Apple Stock Assessing The Impact Of Buffetts Succession

May 24, 2025 -

Analyzing Berkshire Hathaways Apple Holdings Post Buffett Ceo Transition

May 24, 2025

Analyzing Berkshire Hathaways Apple Holdings Post Buffett Ceo Transition

May 24, 2025