Smart Shopping On A Budget: Getting The Most For Your Money

Table of Contents

Planning and Prioritization: The Foundation of Smart Shopping

Smart shopping starts long before you even step foot in a store (physical or online). It begins with careful planning and prioritization of your spending.

Creating a Realistic Budget

Before you can even think about smart shopping, you need a clear understanding of your finances. This involves:

- Tracking your spending: Use budgeting apps (Mint, YNAB, Personal Capital), spreadsheets, or even a notebook to monitor where your money goes.

- Categorizing your expenses: Divide your spending into essential needs (housing, food, transportation), wants (entertainment, dining out), and savings.

- Identifying areas for reduction: Analyze your spending categories to pinpoint areas where you can cut back without significantly impacting your lifestyle.

- Utilizing budgeting apps: Many free and paid apps offer automated tracking, budgeting tools, and insightful reports to help you manage your finances effectively.

Differentiating between needs and wants is critical. Needs are essential for survival and well-being, while wants are desirable but not essential. Prioritizing needs ensures you allocate funds to crucial expenses before indulging in wants. Consider using budgeting methods like the 50/30/20 rule (50% needs, 30% wants, 20% savings) or zero-based budgeting (allocating every dollar to a specific purpose).

Setting Shopping Goals and Priorities

Once you have a budget, set realistic shopping goals. This involves:

- Prioritizing essential purchases: Focus on necessities before buying non-essential items.

- Creating a shopping list: Avoid impulse buys by sticking to a pre-planned list of items you need.

- Avoiding impulse buys: Resist the urge to buy things you don't need, especially when stressed or bored.

- Setting savings goals alongside spending goals: Integrate saving into your budget to achieve both short-term and long-term financial objectives.

Focusing on needs before wants ensures that your essential expenses are covered, leaving you with more control over your discretionary spending. Sticking to your plan is key to successful budget management and smart shopping habits.

Mastering the Art of Comparison Shopping

Comparison shopping is a cornerstone of smart shopping on a budget. It involves actively seeking the best deals and prices before making a purchase.

Utilizing Online Price Comparison Tools

Leverage the power of technology to find the best prices:

- Popular price comparison websites and apps: Google Shopping, PriceGrabber, Bizrate, and others allow you to compare prices from various retailers quickly.

- Checking shipping costs and return policies: Factor in shipping fees and understand return policies before finalizing a purchase. Free shipping can sometimes be offset by higher prices.

- Using browser extensions for price comparison: Extensions like Honey and Rakuten can automatically search for coupons and better prices while you shop.

Effective use of these tools can save you significant amounts of money over time.

Exploring Different Retailers and Sales Channels

Don't limit yourself to a single retailer:

- Compare prices across different stores: Check prices at big box stores, smaller independent businesses, and online marketplaces.

- Look for discounts and coupons: Utilize online coupon sites, retailer websites, and loyalty programs to find discounts and coupons.

- Consider buying used or refurbished items: For certain items, buying used or refurbished can dramatically reduce costs while still providing functionality.

Negotiating prices, particularly for large purchases like furniture or electronics, can also lead to significant savings. Remember to politely inquire about potential discounts or better pricing.

Smart Shopping Strategies for Specific Purchases

Let's delve into specific shopping categories and strategies for maximizing your savings.

Grocery Shopping Savvy

Smart grocery shopping can significantly reduce your monthly food expenses:

- Meal planning: Plan your meals for the week to avoid impulse purchases and reduce food waste.

- Using coupons and loyalty programs: Take advantage of store coupons, loyalty cards, and digital coupons for extra savings.

- Buying in bulk (when cost-effective): Only buy in bulk if you'll actually use the items before they expire.

- Choosing store brands: Store brands often offer comparable quality at a lower price than name brands.

- Avoiding processed foods: Processed foods are generally more expensive and less healthy than whole foods.

Reducing food waste is critical; use leftovers creatively and store perishable items properly. Consider using grocery delivery services for easy comparison shopping and potential savings from online-only deals.

Clothing and Apparel Purchases

Clothing purchases can quickly drain your budget. Implement these strategies:

- Shopping during sales and clearance events: Wait for seasonal sales, end-of-season clearances, and holiday sales to find great deals.

- Buying versatile clothing items: Invest in versatile pieces that can be mixed and matched to create various outfits.

- Opting for quality over quantity: Buy fewer, higher-quality items that will last longer than many cheap items.

- Utilizing clothing rental services: Rent clothing for special occasions rather than buying items you'll only wear once.

Always check reviews before purchasing clothing online to ensure quality and fit. Proper clothing care extends the lifespan of your garments, saving you money in the long run.

Avoiding Common Shopping Pitfalls

Even with careful planning, some common pitfalls can sabotage your smart shopping efforts.

Impulse Buying and Emotional Spending

Impulse buying and emotional spending are major budget busters:

- Strategies to overcome impulse buying: Wait 24 hours before making non-essential purchases. This allows you to assess whether you truly need the item.

- Understanding emotional triggers: Identify situations that lead to emotional spending and develop strategies to avoid them.

- Alternative ways to manage stress and emotions: Find healthier ways to cope with stress and emotions, such as exercise, meditation, or spending time with loved ones.

Mindful spending involves being fully aware of your purchases and their impact on your budget.

Hidden Fees and Charges

Beware of hidden costs that can inflate your final bill:

- Reading the fine print: Carefully read all terms and conditions before making a purchase.

- Being aware of shipping costs, taxes, and additional fees: Factor in all costs before committing to a purchase.

- Comparing total costs before purchasing: Don't just look at the price tag; consider all associated fees.

- Understanding return policies and potential restocking fees: Know the return policy before purchasing in case you need to return an item.

- Avoiding subscription traps: Be aware of automatic renewals and cancel subscriptions you no longer need.

Conclusion

Smart shopping on a budget isn't about deprivation; it's about making conscious choices that align with your financial goals. By planning effectively, mastering comparison shopping, strategically making purchases, and avoiding common pitfalls, you can significantly improve your financial well-being. Remember the key takeaways: budgeting, prioritization, comparison shopping, and mindful spending are crucial for success. Smart shopping on a budget empowers you to save money, achieve your financial goals, and enjoy a more financially secure future. Start practicing smart shopping on a budget today and see the difference it makes to your finances!

Featured Posts

-

Week 26 Recap 2024 25 High School Confidential

May 17, 2025

Week 26 Recap 2024 25 High School Confidential

May 17, 2025 -

Updated Injury Report Mariners Vs Athletics March 27 30

May 17, 2025

Updated Injury Report Mariners Vs Athletics March 27 30

May 17, 2025 -

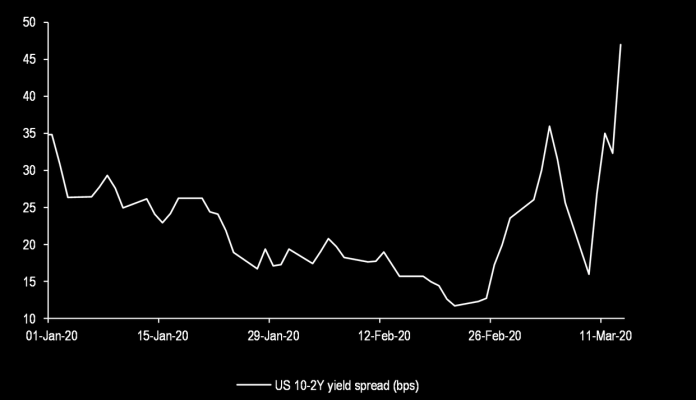

Japans Bond Market Steep Yield Curve Poses Challenges

May 17, 2025

Japans Bond Market Steep Yield Curve Poses Challenges

May 17, 2025 -

Moto Racing News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025

Moto Racing News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025 -

Analyzing The Giants And Mariners Injured Lists Before The April 4 6 Series

May 17, 2025

Analyzing The Giants And Mariners Injured Lists Before The April 4 6 Series

May 17, 2025

Latest Posts

-

Government Crackdown On Delinquent Student Loan Borrowers What You Need To Know

May 17, 2025

Government Crackdown On Delinquent Student Loan Borrowers What You Need To Know

May 17, 2025 -

Segunda Presidencia Trump Que Significa Para Los Deudores De Prestamos Estudiantiles

May 17, 2025

Segunda Presidencia Trump Que Significa Para Los Deudores De Prestamos Estudiantiles

May 17, 2025 -

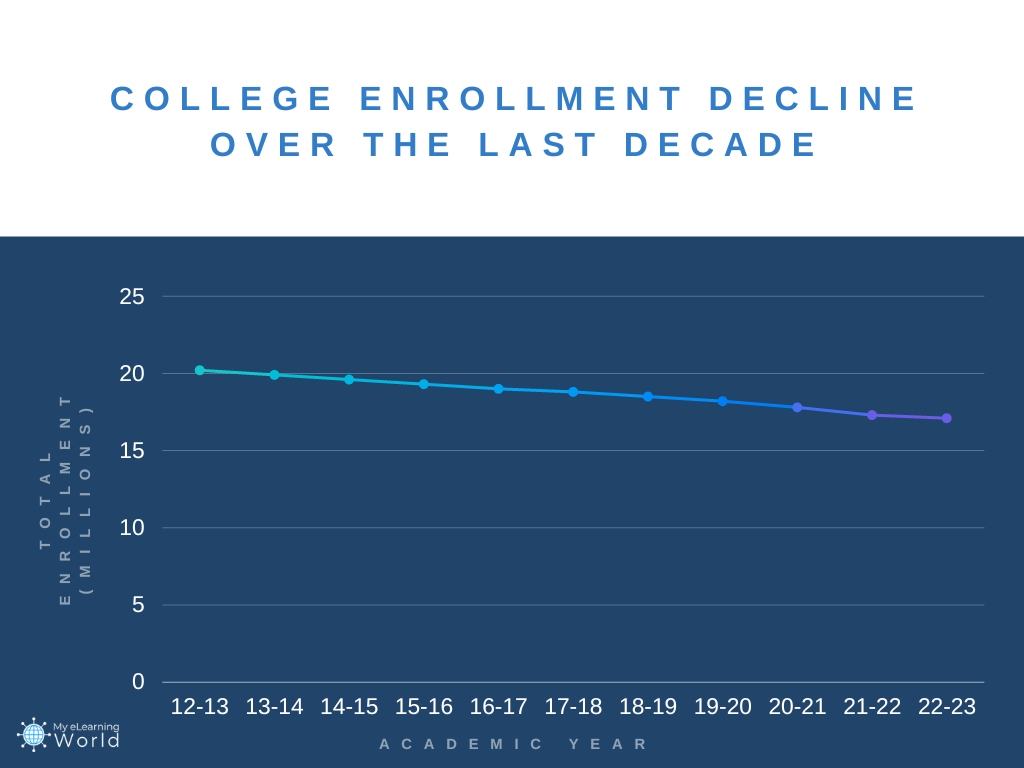

Parental Anxiety Over College Tuition Decreases But Student Loans Persist Survey Data

May 17, 2025

Parental Anxiety Over College Tuition Decreases But Student Loans Persist Survey Data

May 17, 2025 -

Brace For A Credit Score Drop The Impact Of Missed Student Loan Payments

May 17, 2025

Brace For A Credit Score Drop The Impact Of Missed Student Loan Payments

May 17, 2025 -

Futuro Incierto Deudores De Prestamos Estudiantiles Y La Reeleccion De Trump

May 17, 2025

Futuro Incierto Deudores De Prestamos Estudiantiles Y La Reeleccion De Trump

May 17, 2025