Top-Performing DSP India Fund Shifts To Cautious Stance, Increases Cash Holdings

Table of Contents

Reasons for the Shift to a Cautious Stance

The DSP India Fund's decision to adopt a more conservative strategy is driven by a confluence of global and domestic economic headwinds. This proactive approach prioritizes risk mitigation and capital preservation in the face of heightened uncertainty.

Global Economic Headwinds

The global economic landscape is currently characterized by significant uncertainties impacting even robust economies like India's.

- Increased global inflation and potential recessionary pressures: Persistently high inflation rates in many developed economies are forcing central banks to aggressively raise interest rates, increasing the risk of a global recession. This dampens investor sentiment and can negatively impact emerging markets like India.

- Geopolitical instability and its influence on investor sentiment: Ongoing geopolitical tensions and conflicts create significant uncertainty, impacting global supply chains and investor confidence. This uncertainty directly affects capital flows into emerging markets.

- Uncertainty surrounding interest rate hikes by global central banks: The aggressive interest rate hikes by major central banks like the Federal Reserve create a ripple effect, impacting borrowing costs and investment decisions globally, including in India.

- The fund managers cited concerns about the global macroeconomic environment as a primary reason for their cautious approach. This highlights the fund's commitment to proactive risk management.

Domestic Market Challenges

In addition to global challenges, several domestic factors are contributing to the DSP India Fund's cautious stance.

- Rising inflation within India and its impact on consumer spending: Elevated inflation in India is eroding consumer purchasing power and potentially slowing down economic growth. This directly impacts the performance of many Indian companies.

- Potential slowdown in economic growth in key sectors: Certain key sectors of the Indian economy are facing headwinds, potentially leading to a slowdown in overall economic growth.

- Concerns regarding the performance of certain Indian companies: The fund managers may have concerns about the future performance of specific companies within their portfolio, leading them to reduce exposure to equities.

- The fund managers highlighted the need to be prepared for potential corrections in the Indian stock market. This reflects a forward-looking approach, prioritizing risk management over aggressive growth.

Increased Cash Holdings: A Defensive Strategy

The significant increase in cash holdings by the DSP India Fund represents a deliberate defensive strategy aimed at protecting investor capital and navigating uncertain market conditions.

Protecting Investor Capital

Raising cash reserves provides a crucial buffer against market volatility.

- Raising cash reserves allows the fund to withstand market volatility and protect investors' capital. This strategy prioritizes preserving the value of existing investments.

- The strategy prioritizes capital preservation over aggressive growth in the short term. This approach is designed to minimize potential losses during periods of market turmoil.

- Provides flexibility to capitalize on potential buying opportunities during market dips. Increased cash reserves allow the fund to strategically deploy capital when attractive investment opportunities arise.

- This strategic increase in cash holdings is a clear indication of a defensive posture, prioritizing risk management. This proactive approach is designed to mitigate potential losses and safeguard investor assets.

Implications for Investors

The increased cash holdings in the DSP India Fund have implications for investors, impacting both potential returns and risk exposure.

- Potential for lower returns in the short term due to reduced exposure to equities. A higher cash allocation generally translates to lower short-term returns compared to a fully invested portfolio.

- Increased stability and reduced risk for investors seeking capital preservation. This strategy is well-suited for investors prioritizing capital preservation over aggressive growth.

- Opportunities for future gains once market conditions improve. The cash reserves position the fund to capitalize on future opportunities when market conditions become more favorable.

- Investors should understand that this shift prioritizes long-term stability over short-term gains. This is a key consideration for investors evaluating the suitability of the fund for their investment goals.

Analysis of the DSP India Fund's Performance

Analyzing the DSP India Fund's past performance is crucial for understanding the context of its current strategic shift.

- Review of the fund's past performance and its track record: A review of the fund's historical performance provides valuable insights into its risk-adjusted returns and its ability to navigate market cycles.

- Discussion of the fund's investment philosophy and its alignment with the current strategy: The fund's investment philosophy, whether value investing, growth investing, or a blend, should be considered in relation to its current cautious stance.

- Comparison of the fund's performance against its benchmark index: Comparing the fund's performance against its benchmark index reveals how effectively the fund has managed risk and generated returns relative to its peers.

- Examining the fund’s historical performance helps contextualize this strategic shift. Understanding past performance provides context for assessing the implications of the fund's current strategy.

Conclusion

The DSP India Fund's decision to adopt a cautious stance and increase cash holdings is a prudent response to the current economic uncertainties, both globally and domestically. While this may lead to lower short-term returns, it prioritizes capital preservation and positions the fund favorably for future growth opportunities. Investors should carefully assess their own risk tolerance and investment goals before making any decisions. Understanding the reasons behind the change in the DSP India Fund's approach is crucial for making informed investment decisions in the Indian equity market. For a more in-depth analysis of the DSP India Fund and similar investment strategies, further research and consultation with a financial advisor are strongly recommended.

Featured Posts

-

Adhd Medisinering Og Skole Funn Fra Ny Fhi Rapport

Apr 29, 2025

Adhd Medisinering Og Skole Funn Fra Ny Fhi Rapport

Apr 29, 2025 -

Riviera Blue Porsche 911 S T Exceptional Condition Now Available

Apr 29, 2025

Riviera Blue Porsche 911 S T Exceptional Condition Now Available

Apr 29, 2025 -

Thirty Six Years After The Crime An Ohio Doctor Faces Parole His Sons Dilemma

Apr 29, 2025

Thirty Six Years After The Crime An Ohio Doctor Faces Parole His Sons Dilemma

Apr 29, 2025 -

Is Kevin Bacon Returning For Tremor 2 A Look At The Netflix Series Rumors

Apr 29, 2025

Is Kevin Bacon Returning For Tremor 2 A Look At The Netflix Series Rumors

Apr 29, 2025 -

How To Buy Capital Summertime Ball 2025 Tickets Tips And Tricks

Apr 29, 2025

How To Buy Capital Summertime Ball 2025 Tickets Tips And Tricks

Apr 29, 2025

Latest Posts

-

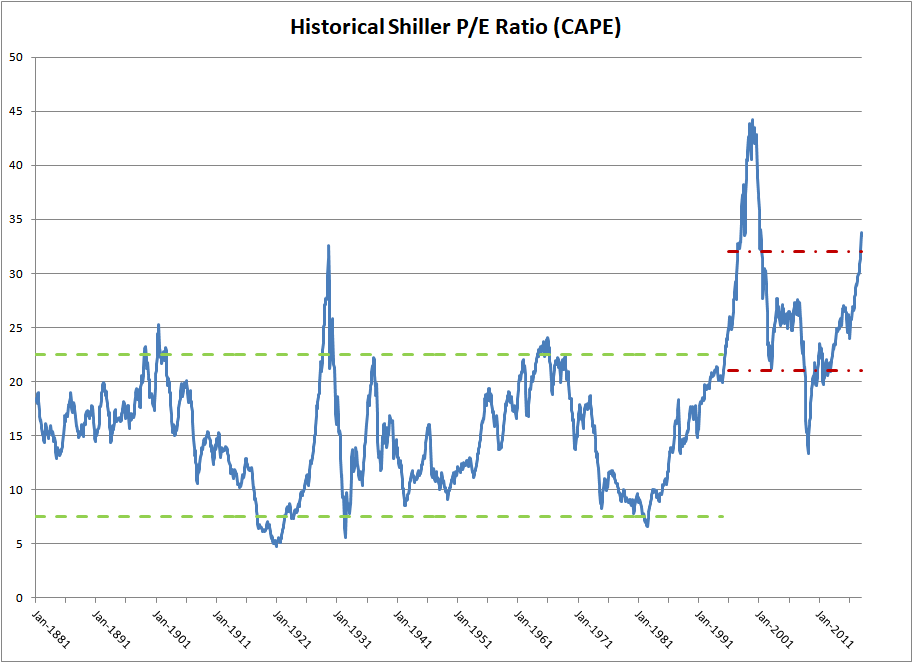

Elevated Stock Market Valuations Why Bof A Remains Confident

May 12, 2025

Elevated Stock Market Valuations Why Bof A Remains Confident

May 12, 2025 -

High Stock Valuations Bof As View And Investor Implications

May 12, 2025

High Stock Valuations Bof As View And Investor Implications

May 12, 2025 -

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

May 12, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

May 12, 2025 -

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025 -

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025