Trade Tensions And The G-7: A Focus On Financial Cooperation

Table of Contents

The Impact of Trade Tensions on Global Financial Stability

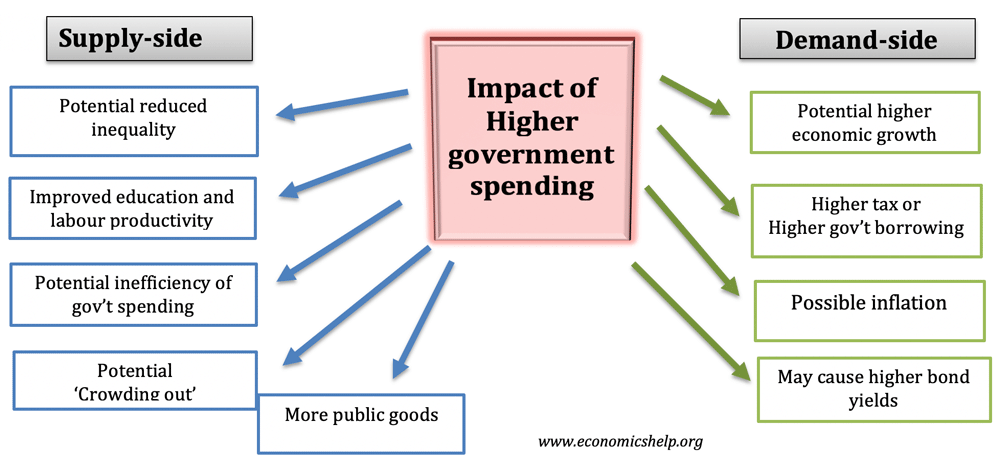

The interconnectedness of global trade and finance is undeniable. Trade wars and protectionist policies, designed to shield domestic industries, often have far-reaching and unforeseen consequences on financial markets. These actions introduce significant uncertainty, impacting investor confidence and leading to volatility in stock markets and currency fluctuations. The imposition of tariffs, for instance, can disrupt supply chains, increase input costs for businesses, and ultimately lead to higher inflation for consumers.

- Increased uncertainty for investors: Unpredictable trade policies make it difficult for businesses to plan for the future, leading to reduced investment and economic growth.

- Supply chain disruptions leading to inflation: Tariffs and trade restrictions increase the cost of imported goods, contributing to inflationary pressures.

- Reduced international trade volumes: Trade wars inherently lead to a decrease in the overall volume of goods and services exchanged internationally.

- Negative impact on global GDP growth: The disruption of trade flows and reduced investment negatively impact overall economic growth globally.

Real-world examples, such as the US-China trade war of 2018-2020, vividly illustrate the significant negative impact of trade tensions on global financial stability. This conflict saw substantial market volatility, currency fluctuations, and a slowdown in global economic growth. The ripple effects were felt across various sectors and economies worldwide.

G-7 Mechanisms for Financial Cooperation in Times of Trade Tension

The G7 serves as a crucial forum for coordinating economic and financial policies amongst its member nations. Recognizing the interconnectedness of their economies, the G7 actively works to mitigate trade-related financial risks. Through joint statements, communiqués, and coordinated policy actions, the G7 aims to promote stability and prevent escalation of trade disputes.

- Joint statements and communiqués on trade and finance: These public pronouncements demonstrate a collective commitment to open and rules-based trade and outline coordinated approaches to managing financial risks.

- Coordination of monetary and fiscal policies: The G7 members often collaborate on monetary and fiscal policies to address macroeconomic challenges stemming from trade tensions, such as coordinated interest rate adjustments or fiscal stimulus packages.

- Financial assistance and support for vulnerable economies: Through institutions like the IMF and World Bank, the G7 provides financial assistance and technical support to countries disproportionately impacted by trade disputes.

- Promotion of open and fair trade practices: The G7 advocates for a rules-based international trading system, encouraging adherence to multilateral agreements and discouraging protectionist measures.

The collaboration between the G7 and international organizations like the International Monetary Fund (IMF) and the World Bank is essential in amplifying the impact of these efforts. These organizations provide technical expertise, financial resources, and a platform for multilateral dialogue.

Strengthening Financial Cooperation Within the G7: Addressing Future Challenges

Despite the G7's significant efforts, challenges remain. The effectiveness of G7 financial cooperation can be hampered by differing national interests, the complexity of global financial markets, and the rapid evolution of the global economic landscape.

- Enhanced information sharing and data analysis: Improved data sharing and analytical capabilities would facilitate more effective policy responses to emerging trade disputes.

- Improved coordination mechanisms between G7 members: Streamlined communication and decision-making processes within the G7 are crucial for rapid and effective responses to evolving trade tensions.

- Increased engagement with emerging economies: Involving emerging economies in the dialogue and policymaking processes can enhance global economic stability and prevent unilateral actions that exacerbate trade tensions.

- Adaptation to new technologies and financial innovations: The rise of digital finance and fintech requires the G7 to adapt its regulatory frameworks and cooperation mechanisms.

Case Studies: Examining Specific Instances of G-7 Response to Trade Disputes

Analyzing past instances of G7 responses to trade disputes offers valuable insights. For example, the G7’s response to the 2008 financial crisis demonstrated the importance of coordinated fiscal stimulus measures in mitigating the impact of a global economic shock. However, the responses to more recent trade disputes, such as the US-China trade war, highlight the challenges in achieving consensus and implementing effective solutions amongst diverse national interests. Examining specific responses—analyzing their successes and shortcomings—is crucial in informing future strategies for addressing trade tensions and the G7's role in maintaining global financial stability.

The Indispensable Role of G-7 Financial Cooperation in Mitigating Trade Tensions

In conclusion, G7 financial cooperation is indispensable in navigating the complexities of trade tensions and preserving global financial stability. Proactive strategies, enhanced collaboration among G7 members, and increased engagement with emerging economies are critical for mitigating the negative impacts of trade disputes. Understanding the intricacies of Trade Tensions and the G7's role in financial cooperation is crucial. Stay informed about the latest developments and engage in the discussion to foster a more stable and prosperous global economy.

Featured Posts

-

3 Billion Spending Cut By Sse Analysis And Implications For Investors

May 22, 2025

3 Billion Spending Cut By Sse Analysis And Implications For Investors

May 22, 2025 -

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 22, 2025

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 22, 2025 -

Aex Stijging Abn Amro Presteert Sterk In Laatste Kwartaal

May 22, 2025

Aex Stijging Abn Amro Presteert Sterk In Laatste Kwartaal

May 22, 2025 -

Netflix Adds Sesame Street Catch Up On Todays Important Stories

May 22, 2025

Netflix Adds Sesame Street Catch Up On Todays Important Stories

May 22, 2025 -

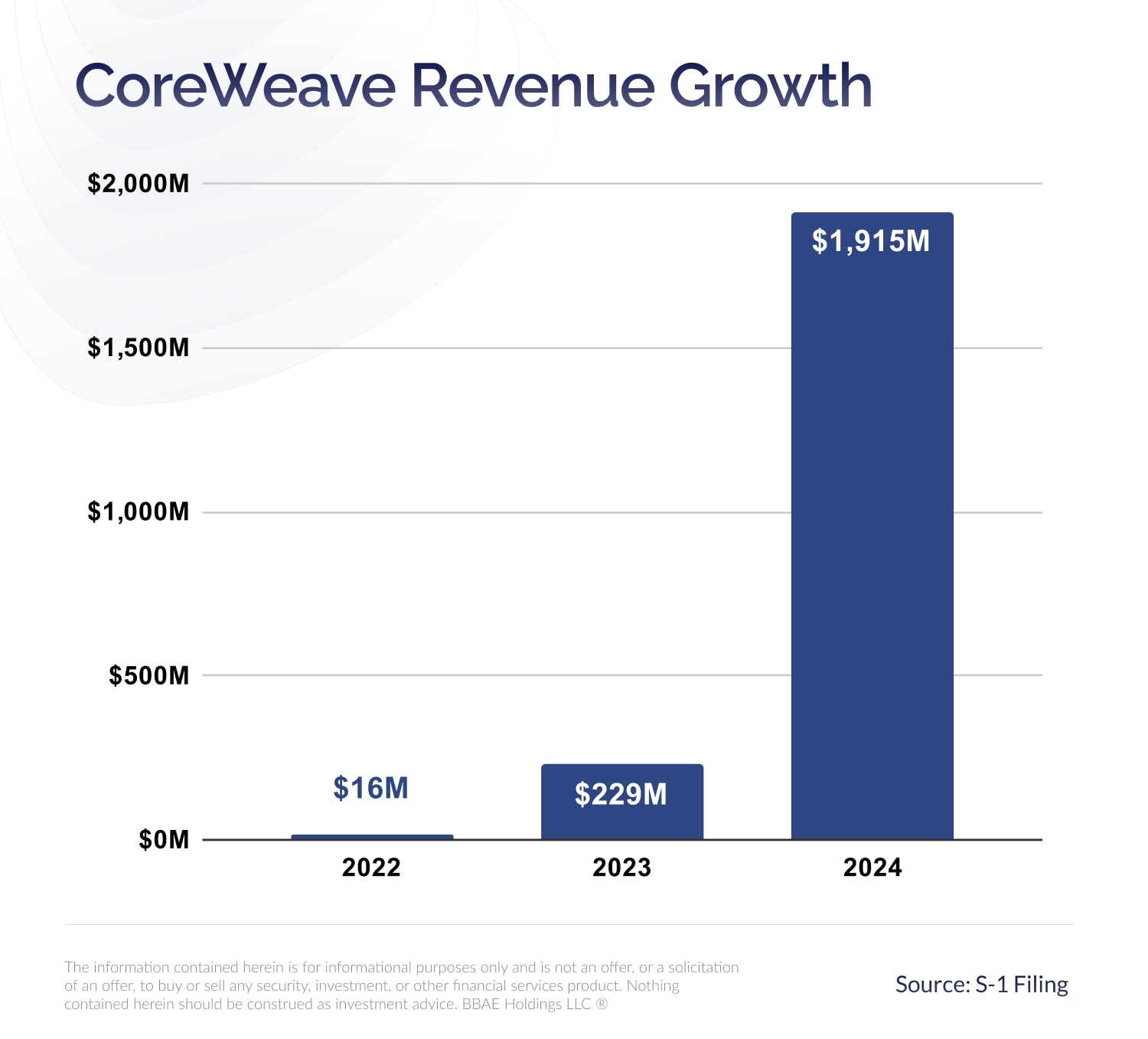

Jim Cramer On Core Weave Crwv Analyzing The Scrappy Companys Success

May 22, 2025

Jim Cramer On Core Weave Crwv Analyzing The Scrappy Companys Success

May 22, 2025

Latest Posts

-

Route 581 Box Truck Collision Results In Road Closure And Delays

May 22, 2025

Route 581 Box Truck Collision Results In Road Closure And Delays

May 22, 2025 -

Box Truck Crash Leads To Significant Route 581 Traffic Disruption

May 22, 2025

Box Truck Crash Leads To Significant Route 581 Traffic Disruption

May 22, 2025 -

Route 581 Shutdown Box Truck Accident Investigation

May 22, 2025

Route 581 Shutdown Box Truck Accident Investigation

May 22, 2025 -

Fed Ex Truck Blaze Closes Portion Of Route 283 Lancaster County

May 22, 2025

Fed Ex Truck Blaze Closes Portion Of Route 283 Lancaster County

May 22, 2025 -

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025