Understanding High Stock Market Valuations: A BofA Perspective For Investors

Table of Contents

Keywords: High stock market valuations, BofA, stock market valuation, market analysis, investment strategy, investor perspective, stock market risk, high valuations, equity valuation, market outlook

The current state of the stock market presents a compelling question for investors: how do we understand and navigate these high stock market valuations? Bank of America (BofA), a leading financial institution, offers valuable insights into this complex landscape. This article will explore BofA's perspective on current market conditions, the factors driving high valuations, associated risks, and effective investment strategies to navigate this environment.

BofA's Current Market Outlook and Valuation Metrics

BofA regularly assesses the stock market's valuation using a variety of metrics to provide a comprehensive market outlook. These metrics help to gauge whether the market is overvalued, undervalued, or trading at fair value. Key valuation metrics employed by BofA include the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), which smooths out earnings fluctuations over a longer period.

-

BofA's view on current market multiples: BofA's recent reports (refer to specific reports and publications here with links if available) often indicate whether current market multiples are considered elevated compared to historical averages. This assessment considers various economic factors and potential future growth.

-

Comparison to historical averages: A crucial aspect of BofA's analysis involves comparing current valuation metrics to their historical averages. This historical context provides a benchmark for assessing whether current valuations are unusually high or within a normal range. Significant deviations from historical norms often warrant careful consideration.

-

Sector-specific valuations: BofA's analysis often delves into sector-specific valuations, highlighting sectors that appear overvalued or undervalued relative to their historical performance and future growth prospects. This granular approach allows investors to make more informed decisions within their portfolios.

-

Supporting BofA Reports: Investors can find detailed analysis and supporting data in BofA's regularly published market research reports and publications. These resources provide deeper insights into their valuation methodologies and market outlook.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current environment of high stock market valuations. Understanding these factors is crucial for making informed investment decisions.

-

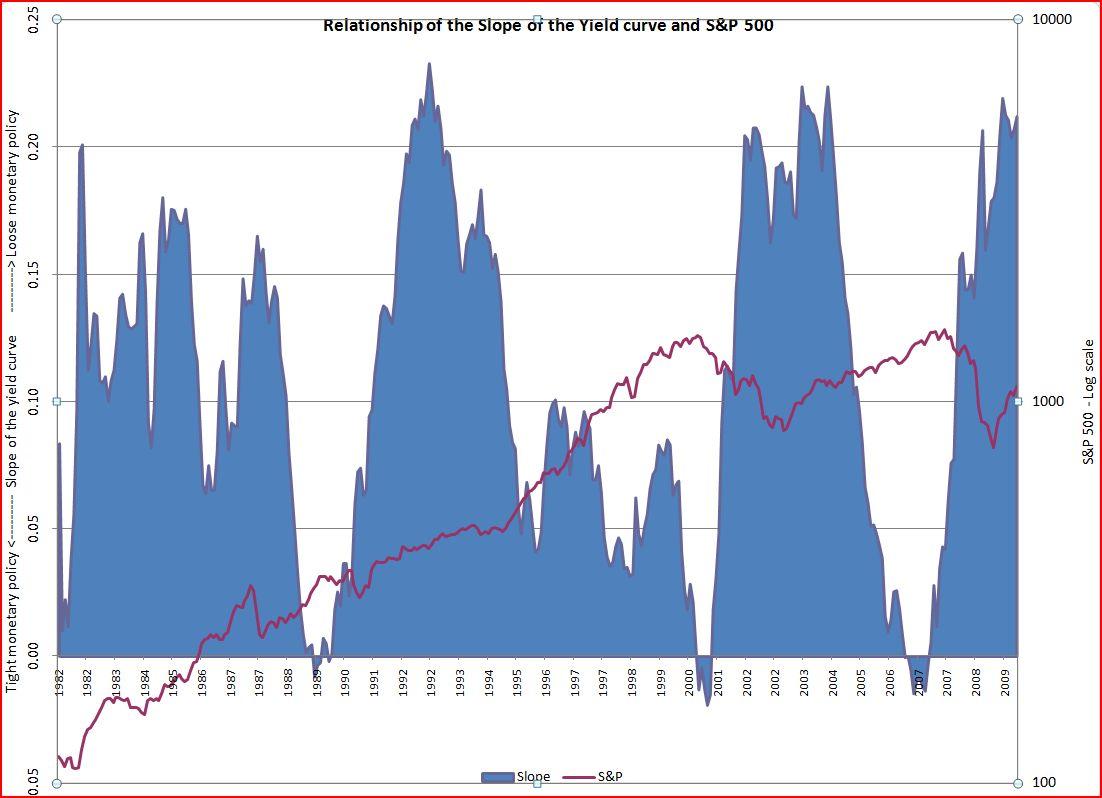

Low interest rate environment: Historically low interest rates have a significant impact on valuations. Lower borrowing costs encourage companies to invest more, leading to increased earnings and potentially higher stock prices. Conversely, lower returns on fixed-income investments make equities a more attractive option, driving up demand.

-

Inflation's impact: Inflation's effect on corporate earnings and stock prices is complex. While inflation can erode purchasing power, it can also lead to increased pricing power for companies, potentially boosting earnings. However, high and unpredictable inflation creates uncertainty, impacting investor sentiment and market valuations.

-

Technological innovation: Rapid technological advancements often fuel higher valuations, especially in the technology sector. Investors are willing to pay premium multiples for companies poised to benefit from disruptive technologies, even if current earnings are relatively low.

-

Investor sentiment: Positive investor sentiment plays a crucial role in driving up stock prices. Optimism about future economic growth and corporate profitability can lead to increased demand, pushing valuations higher. Conversely, negative sentiment can trigger sell-offs.

Potential Risks Associated with High Valuations

Investing in a market characterized by high valuations inherently carries increased risk. It's essential to acknowledge these potential downsides.

-

Interest rate hikes: Central banks often raise interest rates to combat inflation. Higher interest rates increase borrowing costs for companies, potentially slowing economic growth and reducing corporate earnings, which can negatively impact stock prices.

-

Economic slowdown: High valuations often precede periods of economic slowdown or recession. A decline in economic activity can lead to lower corporate earnings and a market correction.

-

Decline in corporate earnings: If corporate earnings fail to meet expectations, the high valuations become less sustainable, leading to a potential market correction or even a crash. This highlights the importance of fundamental analysis.

-

Geopolitical events: Unexpected geopolitical events, such as wars or trade disputes, can significantly impact market sentiment and valuations. These events often introduce uncertainty, leading to market volatility.

Investment Strategies for Navigating High Valuations

Given the current environment of high stock market valuations, a thoughtful investment strategy is crucial. BofA's perspective likely emphasizes diversification and risk management.

-

Portfolio diversification: Diversifying your portfolio across different asset classes (equities, bonds, real estate, etc.) is crucial to mitigating risk. This strategy reduces the impact of any single asset class underperforming.

-

High-quality companies: Focusing on high-quality companies with strong fundamentals, robust balance sheets, and sustainable competitive advantages can help to limit downside risk in a potentially volatile market.

-

Value investing considerations: While growth stocks may be more expensive in a high-valuation market, value investing might present opportunities. Identifying undervalued companies with strong potential for future growth can be a rewarding strategy.

-

Defensive stocks: Consider incorporating defensive stocks, which tend to be less sensitive to economic cycles, into your portfolio. These stocks provide relative stability during market downturns.

-

Alternative investments: Explore alternative investment strategies, such as private equity or hedge funds, to diversify beyond traditional asset classes. However, these often involve higher fees and less liquidity.

Conclusion

BofA's perspective on high stock market valuations highlights the importance of understanding the underlying factors driving these valuations and the associated risks. While a robust economy and low interest rates have contributed to elevated multiples, investors must acknowledge the potential for market corrections due to interest rate hikes, economic slowdowns, or geopolitical events. Effective strategies include diversification, focusing on high-quality companies, and considering value investing alongside defensive positions. Remember, understanding high stock market valuations is crucial for successful long-term investing. Stay informed about fluctuating stock market valuations and learn more about BofA's insights and strategies for navigating these market conditions by visiting [link to relevant BofA resource].

Featured Posts

-

New Reebok Ss 25 Collection Featuring Angel Reese

May 17, 2025

New Reebok Ss 25 Collection Featuring Angel Reese

May 17, 2025 -

The Diverging Views On Japans Steepening Bond Curve

May 17, 2025

The Diverging Views On Japans Steepening Bond Curve

May 17, 2025 -

New York Knicks Mitchell Robinsons Post Surgery Return Season Debut Achieved

May 17, 2025

New York Knicks Mitchell Robinsons Post Surgery Return Season Debut Achieved

May 17, 2025 -

Refinancing Federal Student Loans Is It Right For You

May 17, 2025

Refinancing Federal Student Loans Is It Right For You

May 17, 2025 -

Japans Steep Yield Curve A Growing Concern For Investors And The Economy

May 17, 2025

Japans Steep Yield Curve A Growing Concern For Investors And The Economy

May 17, 2025

Latest Posts

-

Iowa Wrestling Adds National Champion Ben Mc Collum To Coaching Team

May 17, 2025

Iowa Wrestling Adds National Champion Ben Mc Collum To Coaching Team

May 17, 2025 -

When To Refinance Federal Student Loans And When Not To

May 17, 2025

When To Refinance Federal Student Loans And When Not To

May 17, 2025 -

Former D2 Champion Ben Mc Collum Named To Iowa Wrestling Coaching Staff

May 17, 2025

Former D2 Champion Ben Mc Collum Named To Iowa Wrestling Coaching Staff

May 17, 2025 -

U Of U West Valley Expansion 75 Million Eccles Foundation Donation Announced

May 17, 2025

U Of U West Valley Expansion 75 Million Eccles Foundation Donation Announced

May 17, 2025 -

Federal Student Loan Refinancing Everything You Need To Know

May 17, 2025

Federal Student Loan Refinancing Everything You Need To Know

May 17, 2025