Why Current Stock Market Valuations Are Not A Cause For Alarm (BofA)

Table of Contents

The Importance of Context: Comparing Valuations Historically

Relying solely on Price-to-Earnings (P/E) ratios to gauge stock market valuation can be misleading. A single metric, divorced from historical context, offers an incomplete picture. To understand the current situation, we must compare present valuations to past market cycles. History shows periods of significantly higher valuations that weren't immediately followed by catastrophic market crashes.

- Historical P/E Ratio Comparison: Over the past 30 years, the average P/E ratio for the S&P 500 has fluctuated considerably. While current ratios might appear high compared to the long-term average, they're not unprecedented. Several periods in the past saw even higher multiples without triggering immediate market collapses.

- Beyond P/E: A Broader Perspective: Price-to-Earnings isn't the only valuation metric. Other important indicators include the Price-to-Sales (P/S) ratio and the Cyclically Adjusted Price-to-Earnings (CAPE) ratio, which smooths out earnings fluctuations over a longer period. Considering these metrics provides a more comprehensive assessment of stock market valuation.

- Visualizing the Data: Charts and graphs illustrating historical valuations, incorporating P/E, P/S, and CAPE ratios, clearly demonstrate that periods of seemingly high valuations have been followed by periods of significant growth, dispelling the myth that high valuations invariably lead to immediate market crashes.

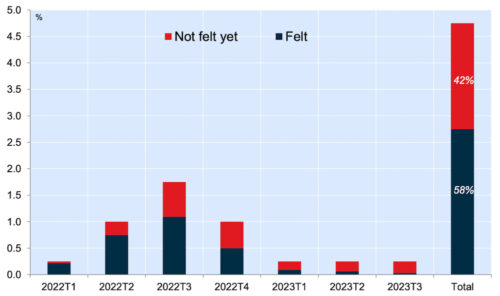

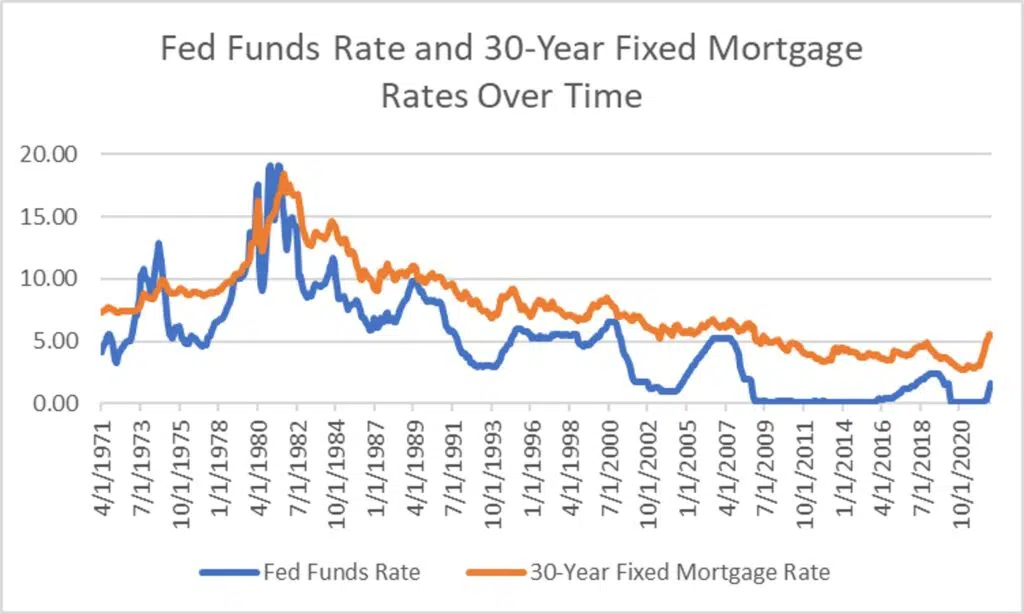

The Impact of Low Interest Rates and Inflation on Stock Valuations

Low interest rates play a crucial role in justifying higher stock valuations. Lower rates reduce the discount rate used in valuation models. This means future earnings are discounted less heavily, leading to higher present values and ultimately, higher stock prices.

- Interest Rates and Discount Rates: The discount rate reflects the opportunity cost of capital. Lower interest rates mean investors demand a smaller return on their investments, leading to higher valuations for companies with promising future cash flows.

- Inflation's Influence: While inflation is a concern, it's not necessarily a death knell for valuations. Inflation can impact earnings growth and future cash flows, but these effects can be factored into sophisticated valuation models. Companies with pricing power and the ability to pass increased costs onto consumers can even benefit from inflationary environments.

- Inflationary Beneficiaries: Certain sectors, such as energy and commodities, often see increased profitability during inflationary periods. A nuanced understanding of how inflation impacts different sectors is crucial for accurate stock market valuation analysis.

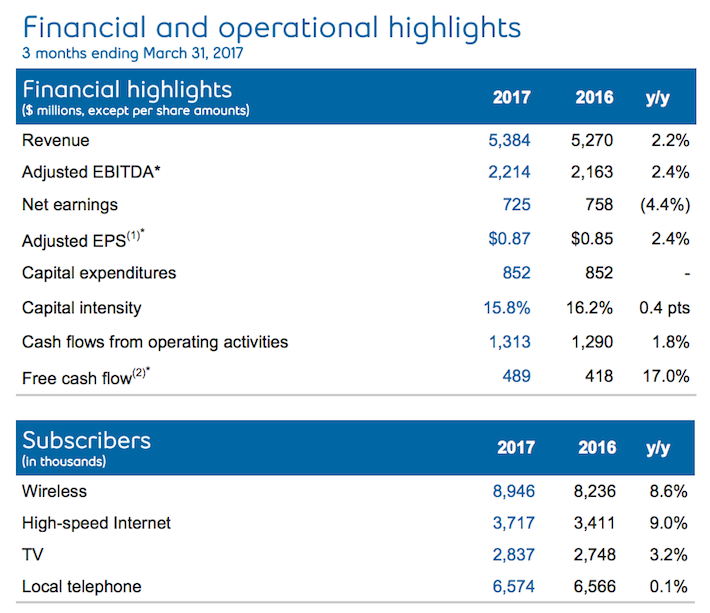

Strong Corporate Earnings and Future Growth Prospects

Many companies are demonstrating robust financial performance, supporting current valuations. Furthermore, projections for future earnings growth contribute significantly to justifying these valuations.

- High-Performing Sectors: Several sectors, including technology, healthcare, and certain consumer staples, have shown remarkable resilience and strong earnings growth, bolstering overall market valuations.

- Drivers of Future Growth: Technological advancements, the expansion into emerging markets, and ongoing innovation are key factors fueling future growth prospects for many companies, providing a solid foundation for current stock market valuations.

- Earnings Growth Forecasts: Reputable financial institutions provide forecasts for earnings growth, offering further support for the current market valuations. These forecasts, coupled with strong current performance, provide a more optimistic outlook.

BofA's Outlook and Recommendations

BofA maintains a generally less alarmist view of the current market situation than many other analysts. They acknowledge the elevated valuations but emphasize the mitigating factors discussed above.

- BofA's Stance: BofA doesn't believe current stock market valuations automatically indicate an imminent crash. Their analysis incorporates a broader perspective, factoring in macroeconomic conditions and future growth potential.

- Investment Strategies: While specific recommendations can change based on market dynamics, BofA generally advocates a long-term, diversified investment strategy, suggesting investors maintain a balanced portfolio rather than reacting drastically to short-term market fluctuations.

- Referencing BofA Research: For a deeper dive into BofA’s detailed analysis and rationale, refer to their publicly available research reports and market commentaries.

Conclusion: Understanding Stock Market Valuations: Don't Panic

In conclusion, while current stock market valuations may appear high at first glance, a comprehensive analysis reveals a more nuanced picture. Historical context, the impact of low interest rates and inflation, and strong corporate earnings with positive future growth prospects all contribute to a less alarming outlook than headlines might suggest. BofA’s perspective reinforces this balanced view. Remember, a thorough understanding of stock market valuations requires considering multiple factors and avoiding knee-jerk reactions to perceived risks. Don't let fear drive your investment decisions. Understand the nuances of stock market valuations, and consider seeking professional financial advice before making any changes to your portfolio based on current market conditions. Learn more about current stock market valuation trends by exploring our resources.

Featured Posts

-

Malaysias Data Center Expansion Focus On Negeri Sembilan

Apr 29, 2025

Malaysias Data Center Expansion Focus On Negeri Sembilan

Apr 29, 2025 -

Son Of Falcons Dc Apologizes For Prank Call To Browns Draft Pick Shedeur Sanders

Apr 29, 2025

Son Of Falcons Dc Apologizes For Prank Call To Browns Draft Pick Shedeur Sanders

Apr 29, 2025 -

Pw C Exits Nine African Nations Implications And Future Outlook

Apr 29, 2025

Pw C Exits Nine African Nations Implications And Future Outlook

Apr 29, 2025 -

Garantia De Gol Evaluando El Desempeno De Alberto Ardila Olivares

Apr 29, 2025

Garantia De Gol Evaluando El Desempeno De Alberto Ardila Olivares

Apr 29, 2025 -

Anthony Edwards Injury Impact On Timberwolves Lakers Game

Apr 29, 2025

Anthony Edwards Injury Impact On Timberwolves Lakers Game

Apr 29, 2025

Latest Posts

-

Economists Forecast Bank Of Canada Interest Rate Reductions Following Tariff Related Job Losses

May 12, 2025

Economists Forecast Bank Of Canada Interest Rate Reductions Following Tariff Related Job Losses

May 12, 2025 -

White House Downplays Uk Trade Deal Impact On North American Automakers

May 12, 2025

White House Downplays Uk Trade Deal Impact On North American Automakers

May 12, 2025 -

Bank Of Canada Rate Cuts Economists Predict Renewed Cuts Amidst Tariff Job Losses

May 12, 2025

Bank Of Canada Rate Cuts Economists Predict Renewed Cuts Amidst Tariff Job Losses

May 12, 2025 -

The Bce Inc Dividend Cut What It Means For Your Investment Strategy

May 12, 2025

The Bce Inc Dividend Cut What It Means For Your Investment Strategy

May 12, 2025 -

Us Rejects Auto Industrys Uk Trade Deal Worries

May 12, 2025

Us Rejects Auto Industrys Uk Trade Deal Worries

May 12, 2025