Addressing High Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

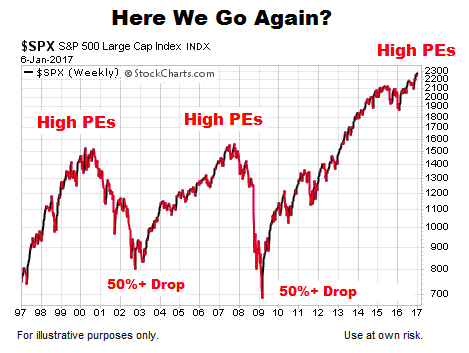

BofA's Rationale Behind High Valuations

BofA's market analysis often emphasizes the role of strong corporate earnings growth in supporting current high stock market valuations. They highlight several factors contributing to this growth:

-

Technological advancements driving productivity gains: Innovation across various sectors continues to boost efficiency and profitability, leading to higher earnings and justifying elevated stock prices. Companies leveraging AI, automation, and data analytics are often cited as examples of this trend.

-

Resilient consumer spending despite inflation: While inflation remains a concern, consumer spending has remained relatively robust. This indicates underlying economic strength and supports corporate revenue streams, underpinning high stock market valuations. BofA’s analysis often points to the strength of the labor market as a key factor contributing to this resilience.

-

Continued corporate efficiency and cost-cutting measures: Companies have implemented various strategies to improve efficiency and reduce costs, boosting profit margins even in the face of inflationary pressures. This includes streamlining operations, leveraging technology, and renegotiating contracts.

-

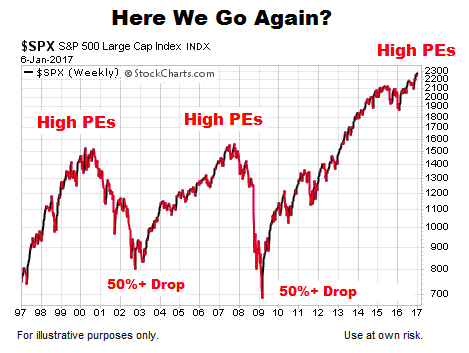

Strategic acquisitions and mergers fueling expansion: Consolidation within industries can lead to increased market share, economies of scale, and enhanced profitability, thus supporting higher stock valuations. BofA's research often highlights successful mergers and acquisitions as positive catalysts for stock performance.

However, it's crucial to acknowledge potential risks. Rising interest rates and persistent inflation could dampen future earnings growth and impact stock valuations. BofA acknowledges these risks but often emphasizes the overall strength of corporate fundamentals in mitigating these challenges. Their analysis typically weighs the positive effects of the aforementioned factors against the potential negative impact of macroeconomic headwinds.

Addressing Inflationary Pressures and Interest Rate Hikes

BofA's analysis carefully considers the impact of inflation and interest rate increases on stock valuations. Their forecasts for inflation and interest rate trajectories typically inform their outlook. They acknowledge that higher interest rates can increase borrowing costs for companies, potentially slowing investment and reducing earnings. Conversely, they also point out that rising rates can reflect a healthy economy and attract foreign investment.

-

Analysis of BofA's forecasts: BofA regularly publishes reports detailing their expectations for inflation and interest rates. These forecasts incorporate various economic indicators and models to predict future trends. These reports are crucial in understanding their overall market outlook.

-

Impact on corporate earnings and stock prices: The relationship between interest rates, inflation, and corporate earnings is complex. BofA's analysis tries to quantify the potential impact of these factors on earnings and, consequently, on stock prices. They look at sensitivity analysis and stress tests to gauge potential market volatility.

-

Mitigating risks: BofA often emphasizes the importance of risk management for investors. Their strategies for mitigating risks typically involve diversification, hedging, and a thorough understanding of the overall economic landscape.

The potential for market corrections is acknowledged by BofA. However, they tend to emphasize the importance of considering long-term investment strategies and focusing on fundamentally strong companies. Investors should remain vigilant and adapt their strategies based on ongoing market developments and BofA's updated analysis.

BofA's Recommended Investment Strategies

Given the current environment of high stock market valuations, BofA suggests a diversified and long-term approach to investment. Their recommendations often include:

-

Portfolio diversification: Spreading investments across various asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk. This diversification strategy is a core element of BofA's recommended approach.

-

Adjusting risk tolerance: Individual investors should carefully consider their risk tolerance and adjust their portfolios accordingly. BofA suggests that investors with a lower risk tolerance might consider a more conservative approach with a higher allocation to bonds, while those with a higher risk tolerance might maintain a greater allocation to equities.

-

Long-term investing: BofA generally encourages long-term investment horizons to weather short-term market fluctuations. They emphasize that focusing on long-term growth, rather than short-term gains, is often the most effective strategy.

-

Sector allocation: BofA identifies specific sectors they believe are well-positioned for growth, offering potential opportunities for investors. These sectors often reflect long-term trends, such as technological innovation, sustainable energy, and healthcare. They typically provide detailed research reports supporting these assessments.

Investors can implement these strategies by carefully reviewing their current portfolios, re-balancing assets based on their risk tolerance, and researching sectors that align with BofA's outlook. Seeking professional financial advice can also be beneficial in customizing an appropriate investment strategy.

Conclusion

BofA's analysis suggests that while high stock market valuations are a legitimate concern, the underlying strength of corporate earnings, coupled with a cautious approach to risk management, can help investors navigate this environment. Their rationale emphasizes the importance of considering factors such as technological advancements, resilient consumer spending, and corporate efficiency, while also acknowledging the potential impact of inflation and interest rate hikes. By understanding the nuanced interplay of these factors and implementing a well-diversified investment strategy tailored to your risk tolerance, you can effectively address high stock market valuations and pursue your long-term financial goals. Learn more about BofA's market outlook and refine your approach to addressing high stock market valuations today!

Featured Posts

-

The Future Of Auditing In Sub Saharan Africa After Pw Cs Withdrawal

Apr 29, 2025

The Future Of Auditing In Sub Saharan Africa After Pw Cs Withdrawal

Apr 29, 2025 -

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025 -

Adhd And Driving Research Based Safety Strategies

Apr 29, 2025

Adhd And Driving Research Based Safety Strategies

Apr 29, 2025 -

Private Consortium Of Elite Universities Defies Trump Administration

Apr 29, 2025

Private Consortium Of Elite Universities Defies Trump Administration

Apr 29, 2025 -

Concern Grows For British Paralympian Missing In Las Vegas For Over A Week

Apr 29, 2025

Concern Grows For British Paralympian Missing In Las Vegas For Over A Week

Apr 29, 2025

Latest Posts

-

High Stock Valuations Bof As View And Investor Implications

May 12, 2025

High Stock Valuations Bof As View And Investor Implications

May 12, 2025 -

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

May 12, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

May 12, 2025 -

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025 -

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025 -

Trumps Embrace Of Cheap Oil Challenges And Consequences For The Energy Industry

May 12, 2025

Trumps Embrace Of Cheap Oil Challenges And Consequences For The Energy Industry

May 12, 2025