Apple Stock Outlook: Post-Q2 Earnings Report

Table of Contents

Apple's Q2 2024 earnings report revealed a mixed bag. While the company exceeded expectations in some areas, other segments fell short, leading to a complex picture for investors. This analysis aims to dissect these results and offer a considered Apple stock outlook.

Q2 Earnings Report Analysis

Revenue and Earnings Performance

Apple's Q2 revenue reached [Insert Actual Revenue Figure], a [Percentage Change]% change compared to the same period last year. This figure, while [Positive/Negative], was [Above/Below/In Line With] analyst expectations. Let's break down the performance by segment:

- iPhone: Revenue of [Insert Figure], representing a [Percentage Change]% year-over-year change. This reflects [Analysis of iPhone sales performance – e.g., strong sales of new models, weaker demand for older models].

- Services: Revenue of [Insert Figure], showing a [Percentage Change]% year-over-year growth. This sustained growth demonstrates the strength and resilience of Apple's services ecosystem.

- Mac: Revenue of [Insert Figure], a [Percentage Change]% year-over-year change. [Analysis of Mac sales performance – e.g., impacted by macroeconomic factors, new product launches].

- iPad: Revenue of [Insert Figure], representing a [Percentage Change]% year-over-year change. [Analysis of iPad sales performance – e.g., reflecting market trends, competition].

- Wearables, Home, and Accessories: Revenue of [Insert Figure], showing a [Percentage Change]% year-over-year change. [Analysis of Wearables performance – e.g., strong growth in Apple Watch sales, impact of new product launches].

Earnings per share (EPS) came in at [Insert EPS Figure], exceeding expectations by [Percentage/Amount]. This EPS growth signifies [Positive/Negative] factors influencing Apple's profitability.

Key Factors Influencing Performance

Several external factors played a significant role in shaping Apple's Q2 performance:

- Supply Chain Disruptions: Ongoing supply chain issues, particularly related to [Specific components or regions], impacted production and availability of certain products.

- Macroeconomic Environment: Concerns surrounding inflation and a potential recession dampened consumer spending, affecting demand for some Apple products.

- Market Competition: Intense competition from rivals in the smartphone, tablet, and PC markets put pressure on Apple's market share and pricing strategies.

Despite these challenges, Apple demonstrated the strength and resilience of its business model, adapting to market conditions and maintaining a strong financial position.

Apple Q3 Guidance for Future Quarters

Apple's management provided guidance for Q3 2024, projecting revenue in the range of [Insert Revenue Guidance Range]. This implies [Analysis of the guidance – e.g., cautious outlook, confidence in future growth]. Key points from their commentary included:

- [Specific statement from management regarding expectations for iPhone sales].

- [Specific statement from management regarding expectations for Services revenue].

- [Specific statement from management regarding investments in new products/technologies].

This guidance suggests [Interpretation of the implications for investors – e.g., potential for stock price appreciation, need for cautious optimism].

Apple Stock Valuation and Price Prediction

Current Market Valuation

Apple's current market capitalization stands at [Insert Market Cap], resulting in a P/E ratio of [Insert P/E Ratio]. Compared to its historical performance and industry peers, this valuation is [High/Low/Average], suggesting [Analysis of the valuation – e.g., potential overvaluation, undervaluation, fair valuation].

Analyst Ratings and Price Targets

Financial analysts offer a range of opinions on Apple's stock. The consensus among analysts currently leans towards a [Buy/Sell/Hold] rating, with price targets ranging from [Low Price Target] to [High Price Target]. The variation reflects differing views on [Factors influencing analyst predictions – e.g., future product launches, macroeconomic conditions].

Potential Risks and Opportunities

Investors should consider both the potential risks and opportunities influencing Apple's stock price:

Risks:

- Increased competition from Android manufacturers.

- Regulatory challenges in various markets.

- A prolonged economic downturn impacting consumer spending.

Opportunities:

- Launch of new innovative products (e.g., AR/VR headsets).

- Expansion into new markets (e.g., emerging economies).

- Further growth of the Services segment.

Conclusion: Apple Stock Outlook Summary and Call to Action

Apple's Q2 earnings report presented a mixed picture, with strong performance in some areas offset by challenges in others. The Apple stock outlook remains somewhat uncertain, reflecting the complex interplay of internal factors and external market forces. While analysts offer a range of predictions, it's crucial to remember that these are just estimates, not guarantees. The Apple stock price will ultimately depend on how Apple navigates these challenges and capitalizes on emerging opportunities.

To make informed investment decisions regarding Apple stock investment, conduct thorough research, monitor Apple stock performance closely, and consider consulting with a qualified financial advisor. Explore additional resources like Apple's investor relations website and reputable financial news outlets to stay updated on the latest developments and further refine your Apple stock analysis. Remember, understanding the Apple stock outlook requires ongoing monitoring and a nuanced understanding of the market.

Featured Posts

-

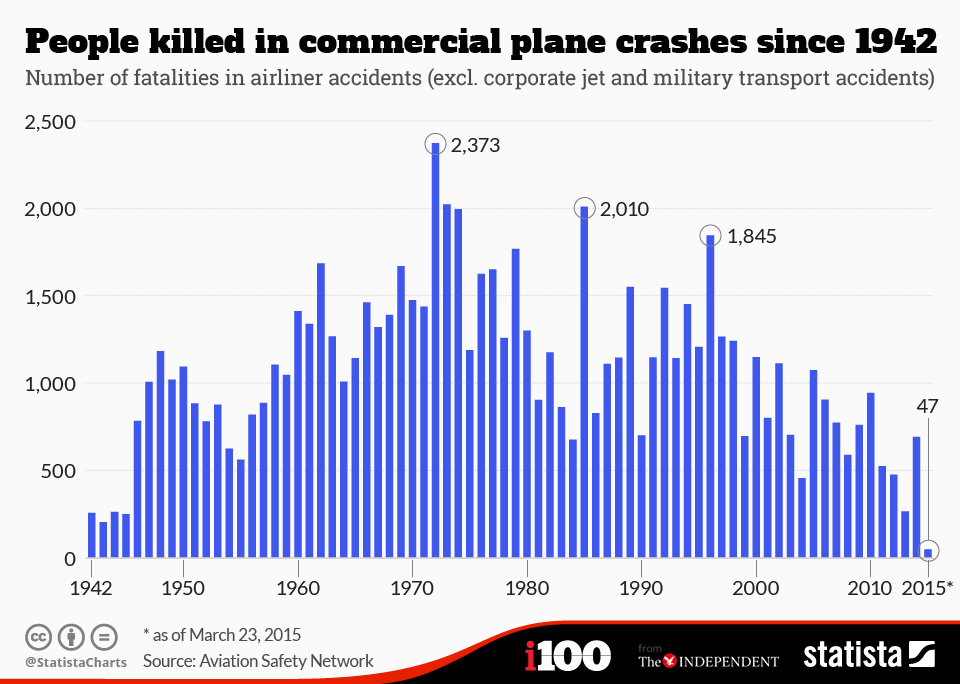

Near Misses And Crashes A Visual Look At Airplane Safety Data

May 24, 2025

Near Misses And Crashes A Visual Look At Airplane Safety Data

May 24, 2025 -

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025 -

Nicki Chapman Reveals How She Made 700 000 From A Country Property Investment

May 24, 2025

Nicki Chapman Reveals How She Made 700 000 From A Country Property Investment

May 24, 2025 -

My Phone My Hope A Tale Of Waiting

May 24, 2025

My Phone My Hope A Tale Of Waiting

May 24, 2025 -

Relx Trotseert Economische Recessie Met Ai Gedreven Groei

May 24, 2025

Relx Trotseert Economische Recessie Met Ai Gedreven Groei

May 24, 2025

Latest Posts

-

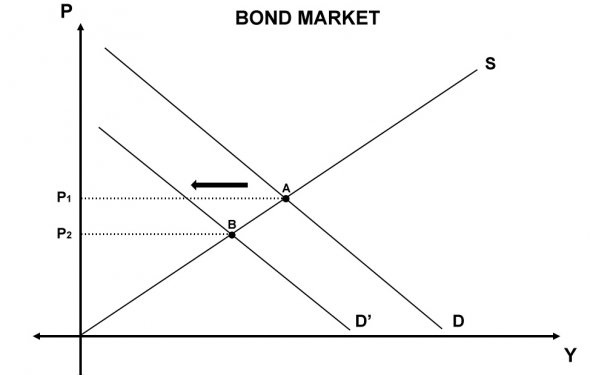

Global Bond Market Instability A Posthaste Warning

May 24, 2025

Global Bond Market Instability A Posthaste Warning

May 24, 2025 -

Broadcoms V Mware Deal At And T Highlights Extreme Cost Increase

May 24, 2025

Broadcoms V Mware Deal At And T Highlights Extreme Cost Increase

May 24, 2025 -

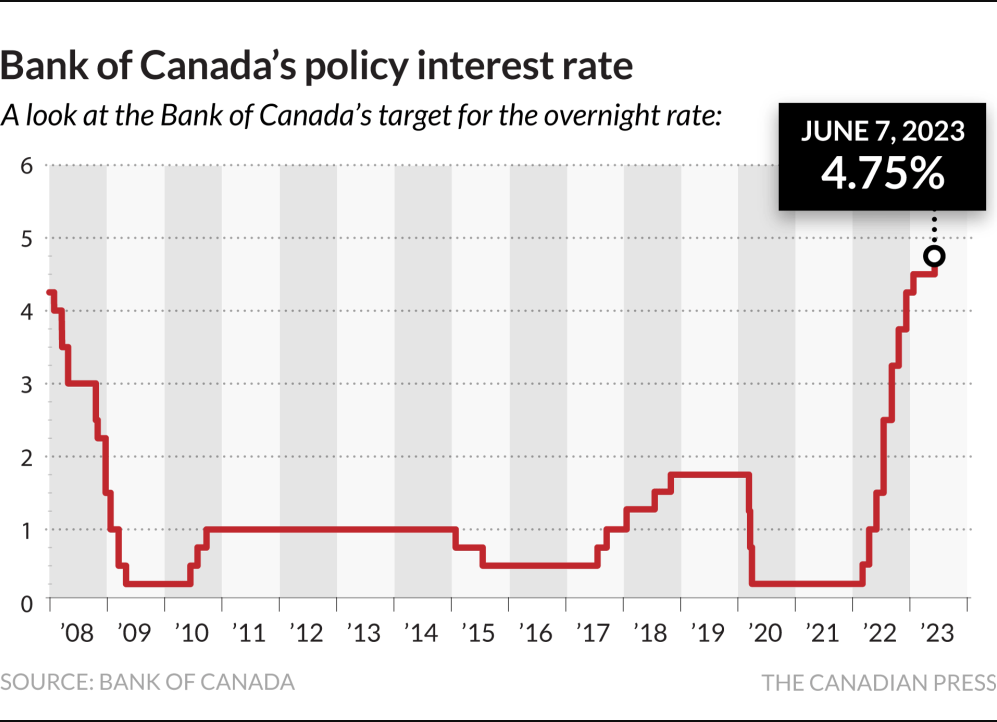

Bank Of Canada To Cut Rates Three More Times Desjardins Prediction

May 24, 2025

Bank Of Canada To Cut Rates Three More Times Desjardins Prediction

May 24, 2025 -

1 050 V Mware Price Increase At And Ts Concerns Over Broadcom Acquisition

May 24, 2025

1 050 V Mware Price Increase At And Ts Concerns Over Broadcom Acquisition

May 24, 2025 -

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

May 24, 2025

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

May 24, 2025