Are High Stock Market Valuations A Cause For Concern? BofA Says No.

Table of Contents

BofA's Rationale for Dismissing Valuation Concerns

BofA's optimistic outlook on high stock market valuations rests on several key pillars. They argue that the current valuations, while seemingly high by historical standards, are justifiable given the prevailing macroeconomic conditions and corporate performance.

The Role of Low Interest Rates

Historically low interest rates play a significant role in supporting high stock market valuations.

- Lower Borrowing Costs: Low interest rates reduce the cost of borrowing for corporations, allowing them to invest more readily in growth initiatives and increase profitability. This, in turn, supports higher stock prices.

- Increased Investor Demand: When interest rates are low, traditional fixed-income investments offer lower returns, pushing investors towards higher-yielding assets like equities. This increased demand bids up stock prices.

- Discounted Cash Flow (DCF) Model Impact: The DCF model, a common valuation technique, uses the discount rate to determine present value. Lower interest rates directly translate to lower discount rates, leading to higher valuations for future cash flows. BofA's recent research highlights this effect, showing a correlation between low rates and elevated P/E ratios across various sectors. (Insert citation to BofA report here, if available).

Strong Corporate Earnings Growth

Robust corporate earnings growth is another key component of BofA's argument. Many sectors have demonstrated exceptional earnings growth in recent years.

- Technology Sector Strength: The technology sector, for example, has shown phenomenal revenue and earnings growth, driving a significant portion of the market's performance. Companies like [insert example of high-performing tech company] have delivered exceptional EPS growth.

- Consumer Discretionary Resilience: Even within the consumer discretionary sector, select companies have shown remarkable resilience and growth, indicating strong consumer confidence despite economic uncertainty. (Provide specific company examples and relevant financial metrics like EPS and revenue growth).

Long-Term Growth Potential

BofA emphasizes the long-term growth potential of the global economy, viewing high stock market valuations as a reflection of future expectations.

- Technological Innovation: Continuous technological advancements are expected to fuel productivity gains and economic expansion.

- Demographic Shifts: In certain regions, demographic trends are anticipated to support long-term economic growth.

- Emerging Markets Growth: The continued development of emerging markets presents significant opportunities for growth and investment.

Counterarguments and Addressing Potential Risks

While BofA presents a compelling case, acknowledging potential risks is crucial for a balanced perspective. High stock market valuations inherently carry risks.

The Risk of a Market Correction

Despite BofA's optimism, the possibility of a market correction remains.

- Rising Interest Rates: A sharp increase in interest rates could trigger a market correction by increasing borrowing costs for companies and reducing investor demand for equities.

- Geopolitical Instability: Global geopolitical events can significantly impact market sentiment and lead to volatility.

- Inflationary Pressures: Persistently high inflation could erode corporate profits and investor confidence, leading to lower valuations.

Overvaluation in Specific Sectors

It's important to note that overvaluation might not be uniform across all sectors.

- Certain Tech Sub-sectors: While the tech sector as a whole has performed strongly, some sub-sectors might be experiencing overvaluation based on metrics like Price-to-Sales ratios.

- Real Estate Market: The real estate market, depending on the region, could also show signs of overvaluation based on Price-to-Book ratios. (Provide specific examples and analysis where possible).

Investment Strategies in a High-Valuation Environment

Navigating a high-valuation environment requires a cautious yet proactive investment approach.

Diversification and Risk Management

Diversification remains a cornerstone of effective risk management.

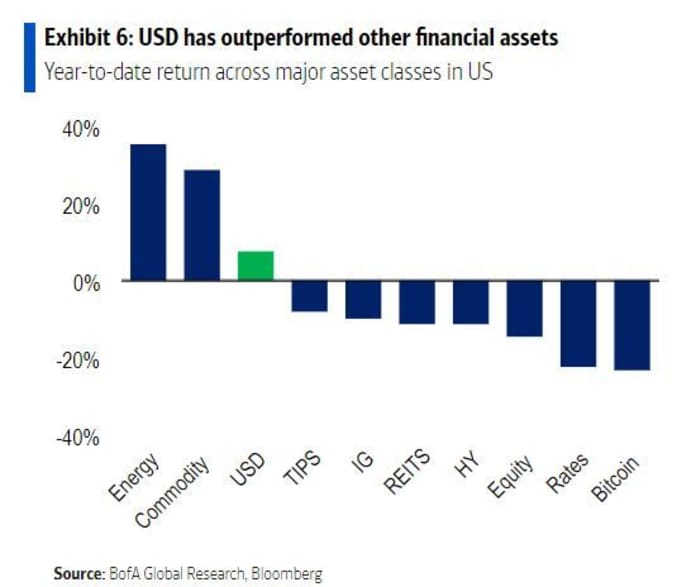

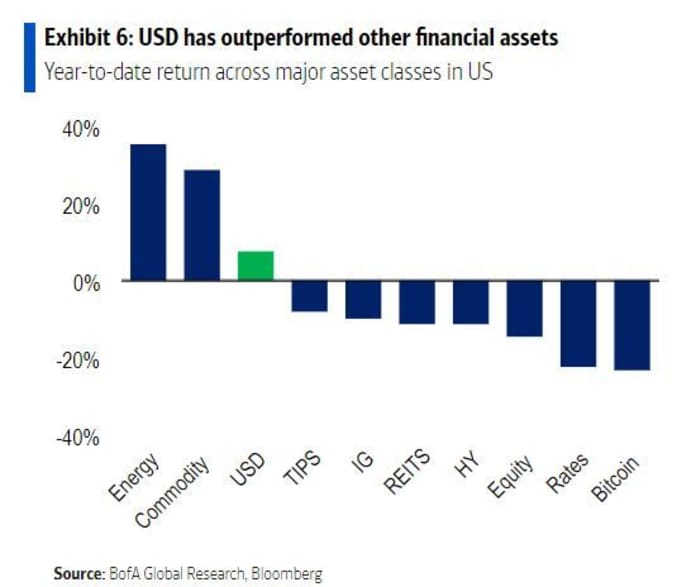

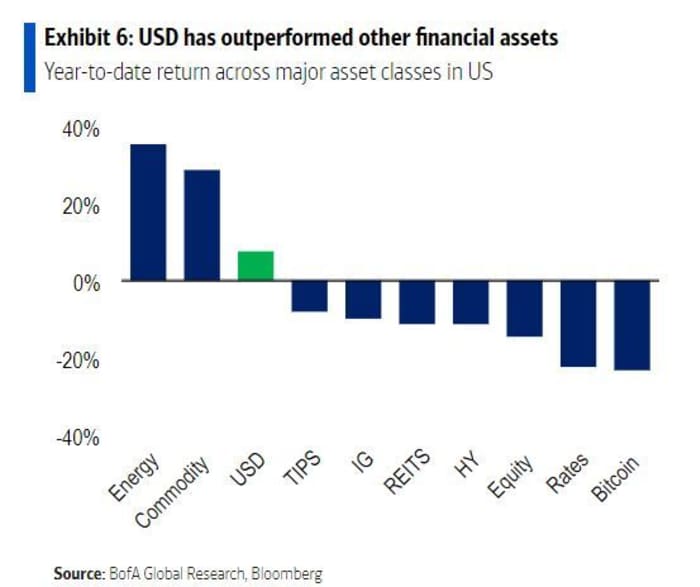

- Asset Allocation: A well-diversified portfolio across various asset classes (equities, bonds, real estate, etc.) is crucial to mitigate risks.

- Sector Diversification: Avoid overexposure to any single sector, particularly those perceived as potentially overvalued.

Focus on Quality and Growth

Selecting high-quality companies with strong growth prospects is crucial.

- Strong Financials: Look for companies with consistent earnings growth, strong balance sheets, and high returns on equity.

- Sustainable Competitive Advantage: Favor companies with sustainable competitive advantages, such as strong brands, innovative technologies, or efficient operations.

Conclusion: Navigating High Stock Market Valuations – BofA's Guidance and Your Next Steps

BofA's optimistic outlook on high stock market valuations is based on low interest rates, strong corporate earnings, and the long-term growth potential of the economy. However, potential risks, such as market corrections and sector-specific overvaluations, must be acknowledged. The key takeaway is the importance of diversification, risk management, and focusing on high-quality, growth-oriented companies when assessing high valuations. Conduct thorough research, consult with a qualified financial advisor, and develop an investment strategy tailored to your individual risk tolerance and financial goals to effectively navigate this environment. Careful assessment of high stock market valuations and proactive portfolio management are essential for long-term investment success.

Featured Posts

-

Trumps Vision For Air Superiority The F 55 And Enhanced F 22

May 17, 2025

Trumps Vision For Air Superiority The F 55 And Enhanced F 22

May 17, 2025 -

May 16th Oil Market A Comprehensive Analysis

May 17, 2025

May 16th Oil Market A Comprehensive Analysis

May 17, 2025 -

Financial Planning Strategies For Student Loan Repayment

May 17, 2025

Financial Planning Strategies For Student Loan Repayment

May 17, 2025 -

Increased Opposition To Ev Mandates From Car Dealerships

May 17, 2025

Increased Opposition To Ev Mandates From Car Dealerships

May 17, 2025 -

Are High Stock Market Valuations A Cause For Concern Bof A Says No

May 17, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

May 17, 2025

Latest Posts

-

Iowa Wrestling Adds National Champion Ben Mc Collum To Coaching Team

May 17, 2025

Iowa Wrestling Adds National Champion Ben Mc Collum To Coaching Team

May 17, 2025 -

When To Refinance Federal Student Loans And When Not To

May 17, 2025

When To Refinance Federal Student Loans And When Not To

May 17, 2025 -

Former D2 Champion Ben Mc Collum Named To Iowa Wrestling Coaching Staff

May 17, 2025

Former D2 Champion Ben Mc Collum Named To Iowa Wrestling Coaching Staff

May 17, 2025 -

U Of U West Valley Expansion 75 Million Eccles Foundation Donation Announced

May 17, 2025

U Of U West Valley Expansion 75 Million Eccles Foundation Donation Announced

May 17, 2025 -

Federal Student Loan Refinancing Everything You Need To Know

May 17, 2025

Federal Student Loan Refinancing Everything You Need To Know

May 17, 2025