Student Loan Debt And Mortgage Qualification: What You Need To Know

Table of Contents

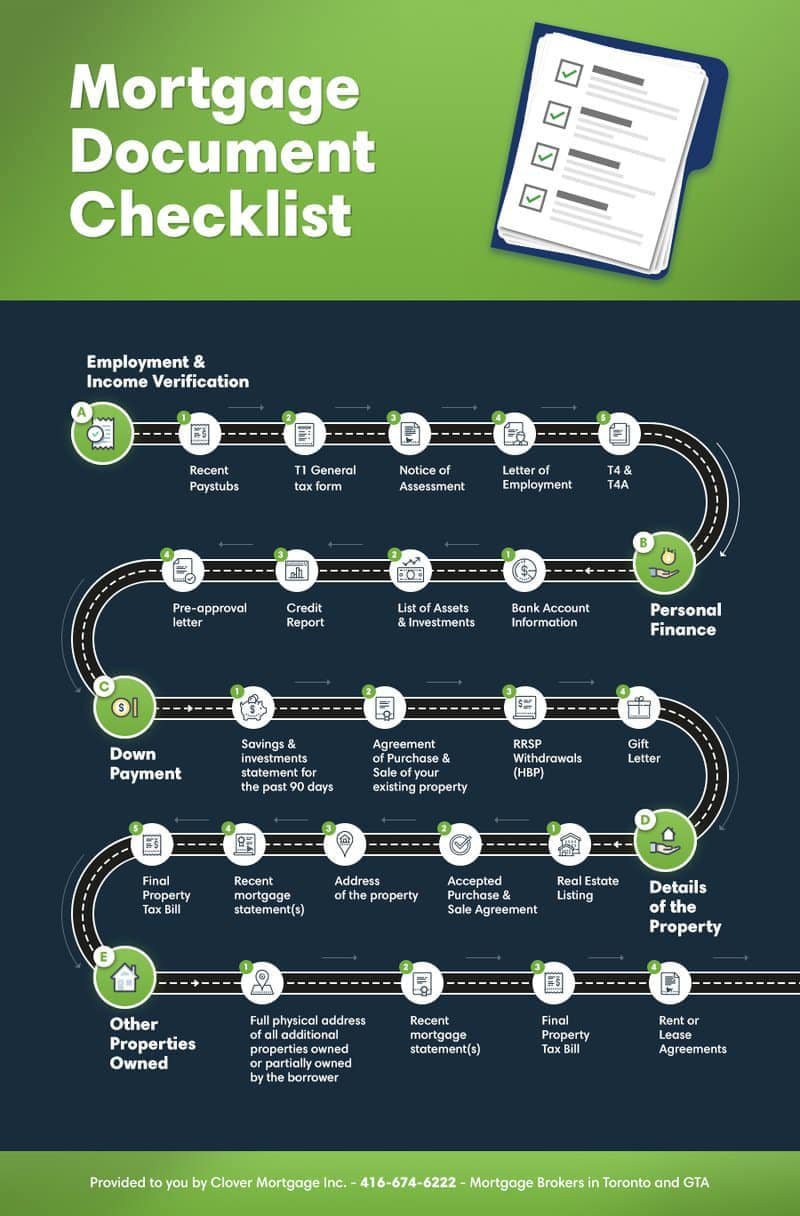

How Lenders Evaluate Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a crucial factor lenders consider when assessing your mortgage pre-approval. DTI represents the percentage of your gross monthly income that goes towards debt payments. A lower DTI indicates a greater capacity to manage additional debt, making you a more attractive borrower. Student loan payments are a significant component of your DTI calculation, alongside credit card payments, auto loans, and other debts.

- Types of debt included in DTI: Credit cards, auto loans, student loans, personal loans, and alimony or child support payments.

- The ideal DTI ratio for mortgage approval: While lenders vary, a DTI below 43% is generally preferred, with some lenders aiming for even lower ratios. A lower DTI significantly increases your chances of mortgage approval and often leads to more favorable interest rates.

- Strategies to improve your DTI: Reducing your debt load through aggressive repayment strategies is vital. Increasing your income through a promotion, a second job, or a side hustle can also positively impact your DTI.

The Impact of Student Loan Payment History on Your Credit Score

Your credit score is another pivotal element in mortgage qualification. Lenders use your credit score to gauge your creditworthiness and risk assessment. A higher credit score translates to better mortgage interest rates and a greater likelihood of approval. Your student loan payment history significantly impacts your credit score. Late or missed payments can severely damage your credit, making it difficult to secure a mortgage.

- The impact of different credit score ranges on mortgage interest rates: Higher credit scores (760+) typically qualify for the lowest interest rates, while lower scores (below 660) can result in significantly higher rates or even rejection.

- Importance of maintaining a positive payment history on all debts: Consistent on-time payments on all debts, including student loans, are crucial for building and maintaining a strong credit score.

- Steps to rebuild credit after negative marks: If you have experienced negative marks on your credit report, taking proactive steps like consistently making on-time payments and reducing your credit utilization can help rebuild your credit over time.

Strategies for Managing Student Loan Debt to Improve Mortgage Chances

Effectively managing your student loan debt is key to improving your mortgage chances. Several student loan repayment plans can influence your DTI and overall financial picture.

- Income-driven repayment plans and their impact on DTI: Plans like Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) calculate your monthly payment based on your income and family size. While this might lower your monthly payments, it could extend your repayment period, potentially impacting your credit score and DTI in the long run.

- Consolidating student loans to potentially simplify payments: Consolidating multiple student loans into a single loan can simplify payment management and potentially lower your monthly payment. However, it may not always reduce your overall interest paid.

- Exploring options like refinancing student loans for better terms: Refinancing can potentially lower your interest rate and monthly payment, thus improving your DTI. However, carefully research the implications, including potential loss of federal loan benefits.

Seeking Professional Advice: Financial Advisors and Mortgage Brokers

Navigating the complexities of student loan debt and mortgage qualification is often challenging. Seeking professional guidance from financial advisors and mortgage brokers can be invaluable.

- How a financial advisor can help create a debt management plan: A financial advisor can help you create a comprehensive debt management plan, considering your income, expenses, and overall financial goals. They can help optimize your debt repayment strategy to improve your DTI and credit score.

- How a mortgage broker can find the best mortgage options: A mortgage broker can compare offers from multiple lenders, helping you find the best mortgage terms and interest rates based on your financial situation.

- The benefits of seeking professional guidance early in the home-buying process: Seeking professional advice early allows for proactive planning and strategic debt management to maximize your chances of securing a mortgage.

Conclusion: Securing Your Future: Student Loan Debt and Mortgage Qualification

Successfully navigating student loan debt and mortgage qualification requires a multi-faceted approach. Understanding your debt-to-income ratio, maintaining a strong credit score through consistent student loan payments, strategically managing your student loan repayment plan, and seeking professional advice are all crucial steps. Don't let student loan debt derail your dreams of homeownership. Start planning your financial strategy today by exploring different student loan repayment options and seeking professional advice on navigating student loan debt and mortgage qualification. Take control of your financial future and secure your path to homeownership.

Featured Posts

-

Sheyenne High Schools Eagleson Recognized For Excellence In Science Education

May 17, 2025

Sheyenne High Schools Eagleson Recognized For Excellence In Science Education

May 17, 2025 -

United States Crypto Casinos Jackbits Position Among The Best

May 17, 2025

United States Crypto Casinos Jackbits Position Among The Best

May 17, 2025 -

High Salary Limited Options A Practical Guide To Career Transition

May 17, 2025

High Salary Limited Options A Practical Guide To Career Transition

May 17, 2025 -

Evaluating Uber Technologies Uber As An Investment

May 17, 2025

Evaluating Uber Technologies Uber As An Investment

May 17, 2025 -

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025

Latest Posts

-

Uber Uber Is It A Good Long Term Investment

May 17, 2025

Uber Uber Is It A Good Long Term Investment

May 17, 2025 -

Uber Stock Soars Understanding Aprils Double Digit Gains

May 17, 2025

Uber Stock Soars Understanding Aprils Double Digit Gains

May 17, 2025 -

Assessing The Investment Potential Of Uber Uber Stock

May 17, 2025

Assessing The Investment Potential Of Uber Uber Stock

May 17, 2025 -

Why Did Uber Stock Jump Over 10 In April

May 17, 2025

Why Did Uber Stock Jump Over 10 In April

May 17, 2025 -

Evaluating Uber Technologies Uber As An Investment

May 17, 2025

Evaluating Uber Technologies Uber As An Investment

May 17, 2025