Analysis: XAUUSD Gold Price Gains Momentum After Weak US Data

Table of Contents

Weak US Economic Data and its Impact on the Dollar

The inverse relationship between the US dollar (USD) and gold prices (XAUUSD) is well-established. A weaker dollar typically translates to a higher gold price, as gold becomes more affordable for buyers holding other currencies. Recent economic data releases from the US have painted a picture of slowing growth, impacting the USD and consequently boosting the XAUUSD gold price.

Specific data points contributing to this weakening of the dollar include:

- Lower-than-expected GDP growth: The latest GDP figures showed a slowdown in economic growth, signaling potential weakness in the US economy. (Source: [Insert reputable source, e.g., Bureau of Economic Analysis]). This dampened investor confidence in the USD.

- Weak employment figures: Disappointing job creation numbers and a rise in unemployment claims indicated a softening labor market. (Source: [Insert reputable source, e.g., Bureau of Labor Statistics]). This further fueled concerns about the US economy's health.

- Declining consumer confidence: A drop in consumer confidence indices suggests reduced spending and a pessimistic outlook for future economic performance. (Source: [Insert reputable source, e.g., Conference Board]). This negative sentiment contributed to the decline in the USD.

These factors combined resulted in a weaker US dollar, making gold, priced in USD, more attractive to international investors. The chart below visually demonstrates the correlation between USD weakness and the XAUUSD price increase:

[Insert chart/graph showing inverse correlation between USD and XAUUSD]

Safe-Haven Demand and Gold's Role

Gold has historically served as a safe-haven asset, providing a hedge against economic uncertainty and geopolitical instability. The weak US economic data fueled a flight to safety, with investors seeking refuge in gold. This increased demand for XAUUSD drove up its price.

- Increased investment in gold ETFs and other gold-related instruments: We've observed a surge in investment in gold exchange-traded funds (ETFs) and other gold-related financial instruments, indicating a significant inflow of capital into the gold market.

- Geopolitical factors: Ongoing geopolitical tensions [mention specific examples if relevant, e.g., Ukraine conflict] can further amplify the demand for safe-haven assets like gold, adding to the price increase.

- Inflation concerns: Persistent inflation concerns also contribute to gold's appeal. Gold is often seen as an inflation hedge, preserving purchasing power during inflationary periods. The current inflationary environment has boosted the XAUUSD gold price further.

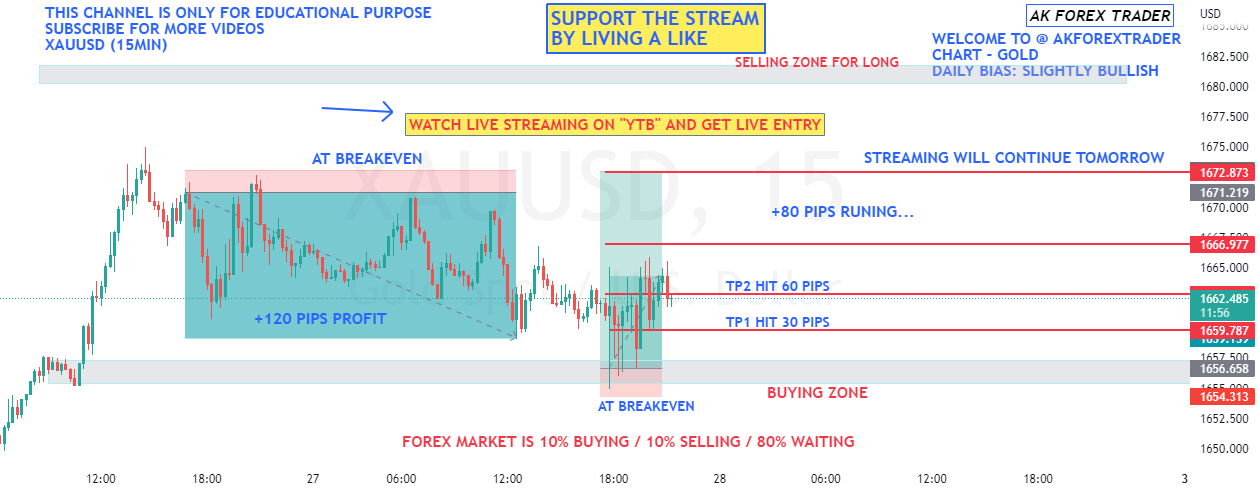

Technical Analysis of XAUUSD Price Movement

A technical analysis of the XAUUSD chart reveals several key indicators supporting the recent price surge. Using moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), we can identify potential trends and future price movements.

- Key support and resistance levels: The XAUUSD price has broken through key resistance levels, suggesting a strong upward momentum. [Specify levels with chart illustration].

- Potential breakout scenarios: The current price action suggests a potential continuation of the upward trend, but careful observation of support and resistance levels is crucial.

- Chart patterns: The chart exhibits [mention specific chart patterns observed, e.g., bullish flag, ascending triangle], which further strengthen the bullish outlook for the XAUUSD gold price.

[Insert charts and graphs illustrating technical analysis]

Trading Implications for XAUUSD

Based on the current analysis, several trading strategies can be considered:

-

Long positions: A long position in XAUUSD might be considered given the current bullish trend, but risk management is paramount.

-

Risk management techniques: Stop-loss orders and proper position sizing are crucial for mitigating potential losses. Avoid over-leveraging.

-

Potential entry and exit points: Technical analysis, combined with fundamental analysis (macroeconomic indicators), should inform entry and exit points. [Suggest potential levels based on chart analysis].

-

Importance of stop-loss orders and position sizing: Implementing stop-loss orders to limit potential losses and carefully managing position size are crucial risk management strategies.

-

Caution against speculative trading: Avoid speculative trading based solely on short-term price movements. A well-informed trading strategy based on both fundamental and technical analysis is essential.

Conclusion

The recent surge in the XAUUSD gold price is largely attributed to the release of weak US economic data, which weakened the US dollar and increased safe-haven demand for gold. Technical analysis supports a bullish outlook for XAUUSD, but traders should employ prudent risk management strategies. Understanding the relationship between macroeconomic factors and XAUUSD price movements is vital for successful trading. By closely monitoring US economic indicators and understanding the dynamics of the XAUUSD market, you can make more informed decisions and potentially capitalize on future price movements. Keep an eye on the XAUUSD gold price and stay tuned for further analysis. Mastering the intricacies of XAUUSD trading requires continuous learning and adaptation to market conditions.

Featured Posts

-

The Changing Landscape Of College Funding A Survey Of Parental Attitudes And Loan Usage

May 17, 2025

The Changing Landscape Of College Funding A Survey Of Parental Attitudes And Loan Usage

May 17, 2025 -

Angel Reese Supports Wnba Players Fight For Better Salaries

May 17, 2025

Angel Reese Supports Wnba Players Fight For Better Salaries

May 17, 2025 -

Tsx Composite Index Record High Intraday

May 17, 2025

Tsx Composite Index Record High Intraday

May 17, 2025 -

Ftc Probe Into Open Ai Chat Gpts Future And Data Privacy Concerns

May 17, 2025

Ftc Probe Into Open Ai Chat Gpts Future And Data Privacy Concerns

May 17, 2025 -

Rare Earth Minerals And The Threat Of A New Cold War

May 17, 2025

Rare Earth Minerals And The Threat Of A New Cold War

May 17, 2025

Latest Posts

-

Midday Interview Securing The Fountain City Classic Scholarship

May 17, 2025

Midday Interview Securing The Fountain City Classic Scholarship

May 17, 2025 -

Is Refinancing Federal Student Loans With A Private Lender Right For You

May 17, 2025

Is Refinancing Federal Student Loans With A Private Lender Right For You

May 17, 2025 -

Would Privatizing Student Loans Under Trump Benefit Or Harm Borrowers

May 17, 2025

Would Privatizing Student Loans Under Trump Benefit Or Harm Borrowers

May 17, 2025 -

Private Lender Refinancing A Guide To Federal Student Loans

May 17, 2025

Private Lender Refinancing A Guide To Federal Student Loans

May 17, 2025 -

Governments Increased Enforcement Of Student Loan Repayment A Borrowers Guide

May 17, 2025

Governments Increased Enforcement Of Student Loan Repayment A Borrowers Guide

May 17, 2025