Jim Cramer's Foot Locker (FL) Pick: A Winning Investment?

Table of Contents

Cramer's Rationale Behind the Foot Locker Pick

Jim Cramer's interest in Foot Locker hasn't been consistently positive, but recent pronouncements suggest a more optimistic view. While pinpointing exact dates and specific statements requires referencing specific Mad Money episodes (links to relevant video clips would be inserted here if available), his rationale generally centers on several key factors.

- Turnaround Strategy: Cramer likely highlighted Foot Locker's efforts to revitalize its brand and adapt to changing consumer preferences. This could involve initiatives such as improved store layouts, enhanced online presence, and collaborations with popular brands.

- Brand Strength: Foot Locker's long-standing presence and recognition in the athletic footwear market likely factored into Cramer's assessment. The brand's loyalty and potential for attracting younger consumers were probably considered crucial.

- Potential for Growth: Cramer's positive outlook likely stems from a belief in Foot Locker's capacity for future growth. This could involve expansion into new markets, diversification of product offerings, or successful execution of its digital transformation strategy.

- Price Target: Although specific price targets are difficult to consistently attribute to Cramer without referencing exact dates and broadcasts, his positive comments would likely imply a belief in upward stock movement.

Foot Locker's Current Financial Performance and Future Outlook

Analyzing Foot Locker's financial performance requires examining recent quarterly and annual reports. While specific numbers fluctuate, a general overview provides context:

- Key Financial Metrics: Tracking revenue, earnings per share (EPS), and the debt-to-equity ratio offers a snapshot of Foot Locker's financial health. A declining debt-to-equity ratio, for example, suggests improved financial stability. (Note: Actual numerical data would be inserted here, referencing reliable financial sources.)

- Growth or Decline Trends: Examining trends in sales and profitability is crucial. Consistent growth signals positive momentum, while a decline raises concerns. Analyzing these trends in relation to industry benchmarks is vital for accurate interpretation.

- Significant Challenges: Foot Locker faces challenges common to brick-and-mortar retailers, including competition from online giants, supply chain disruptions, and evolving consumer preferences. Assessing the company's strategies to overcome these hurdles is essential. The ability to adapt to the growing popularity of e-commerce and the rise of athleisure brands heavily influences the outlook.

Competitive Landscape and Industry Trends

Foot Locker operates in a fiercely competitive landscape. Understanding its position relative to major players is essential.

- Major Competitors: Nike, Adidas, Under Armour, and other major brands pose significant competition. Analyzing Foot Locker's strategies to differentiate itself from these giants is key.

- Market Trends: The rise of e-commerce, the enduring popularity of athleisure wear, and growing concerns about sustainability all significantly impact the athletic footwear and apparel industry. Foot Locker’s response to these trends directly impacts its competitive advantage.

- Competitive Advantages and Disadvantages: Foot Locker's extensive store network can still be a strength, but its ability to compete effectively in the digital realm will determine its long-term success. The company's brand recognition and relationships with key manufacturers provide a competitive edge, but maintaining these advantages requires ongoing strategic adaptation.

Risk Assessment and Potential Downsides

Investing in Foot Locker stock carries inherent risks. A comprehensive risk assessment is crucial:

- Economic Downturns: Economic downturns significantly impact discretionary spending, and athletic footwear is often considered a non-essential purchase. This makes Foot Locker vulnerable during economic uncertainty.

- Decline in Brick-and-Mortar Retail: The ongoing shift towards online shopping poses a continuing threat to brick-and-mortar retailers like Foot Locker. Its ability to adapt to omnichannel retail will be a major factor in its future success.

- Specific Foot Locker Strategies: The success or failure of Foot Locker's specific initiatives (e.g., new product lines, marketing campaigns, store closures) significantly impacts its stock performance. Careful analysis of these strategies is essential for a complete risk assessment.

Conclusion

Whether Jim Cramer's positive assessment of Foot Locker stock translates into a "winning investment" depends on a variety of factors. While his insights may offer valuable perspectives, independent analysis of Foot Locker's financial performance, competitive landscape, and inherent risks is crucial. Weighing the potential for growth against the significant challenges facing the company and the broader retail landscape is essential. Ultimately, the decision to invest in Jim Cramer Foot Locker stock is a personal one. Consider conducting your own thorough research before making any investment decisions. Remember to consult with a financial advisor for personalized advice tailored to your risk tolerance and investment goals. Weigh the potential benefits against the risks before investing in Jim Cramer’s Foot Locker (FL) pick.

Featured Posts

-

Paddy Pimblett Silences Doubters Following Ufc 314 Win Over Michael Chandler

May 16, 2025

Paddy Pimblett Silences Doubters Following Ufc 314 Win Over Michael Chandler

May 16, 2025 -

Boston Celtics Merchandise Shop The Official Collection At Fanatics

May 16, 2025

Boston Celtics Merchandise Shop The Official Collection At Fanatics

May 16, 2025 -

New Study Nearly 100 Million Americans Exposed To Forever Chemicals In Drinking Water

May 16, 2025

New Study Nearly 100 Million Americans Exposed To Forever Chemicals In Drinking Water

May 16, 2025 -

Olimpia Derrota A Penarol 2 0 Goles Resumen Y Analisis Del Encuentro

May 16, 2025

Olimpia Derrota A Penarol 2 0 Goles Resumen Y Analisis Del Encuentro

May 16, 2025 -

Announcing The Kid Cudi Auction On Joopiter Dates Items And How To Bid

May 16, 2025

Announcing The Kid Cudi Auction On Joopiter Dates Items And How To Bid

May 16, 2025

Latest Posts

-

Dismissing Stock Market Valuation Worries A Bof A Analysis

May 17, 2025

Dismissing Stock Market Valuation Worries A Bof A Analysis

May 17, 2025 -

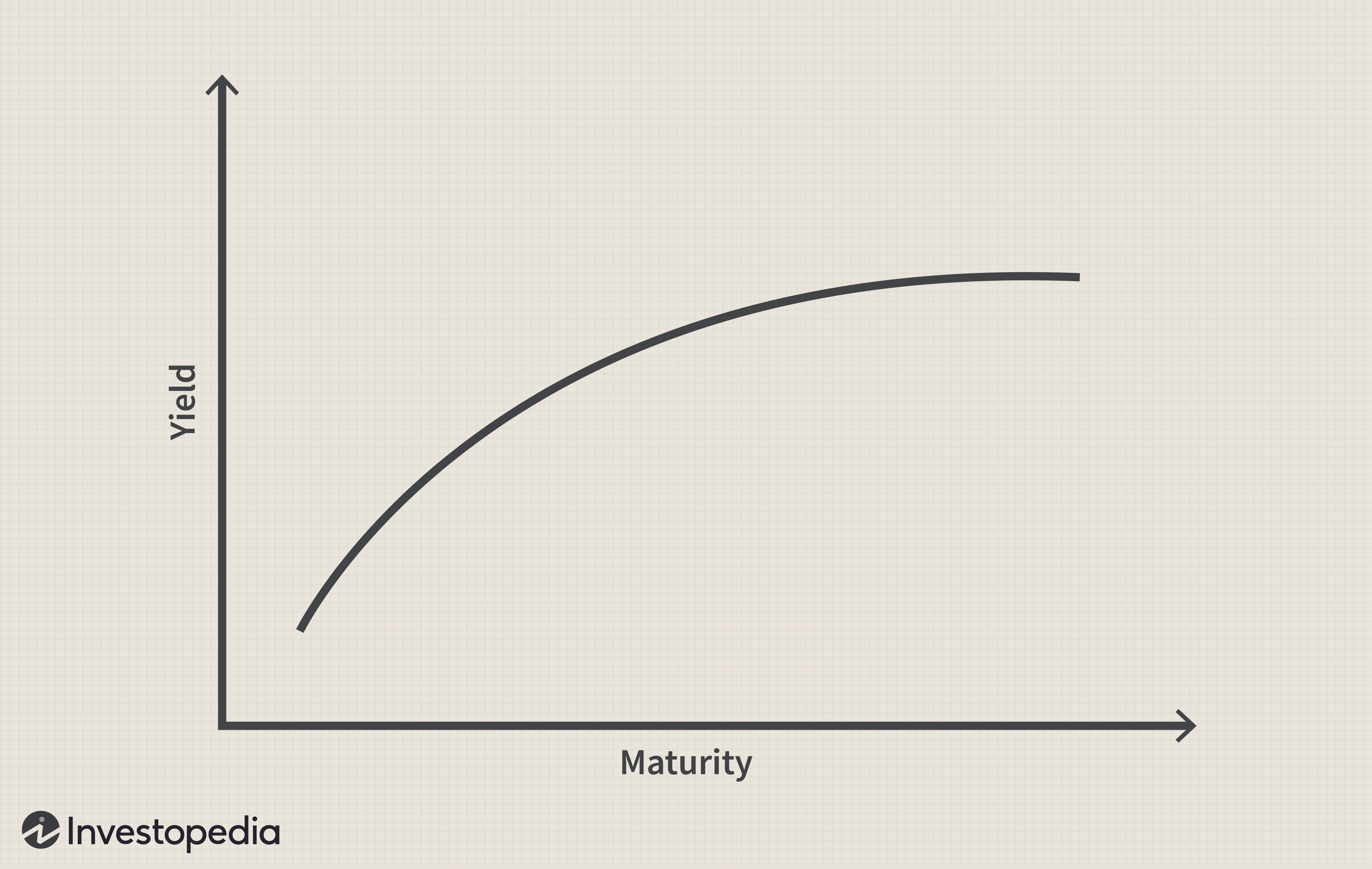

Navigating The Risks Japans Steep Bond Yield Curve And Investment Strategies

May 17, 2025

Navigating The Risks Japans Steep Bond Yield Curve And Investment Strategies

May 17, 2025 -

Understanding High Stock Market Valuations A Bof A Perspective For Investors

May 17, 2025

Understanding High Stock Market Valuations A Bof A Perspective For Investors

May 17, 2025 -

Stock Market Valuations Bof As Analysis And Reasons For Investor Calm

May 17, 2025

Stock Market Valuations Bof As Analysis And Reasons For Investor Calm

May 17, 2025 -

Japanese Government Bonds Navigating The Steep Yield Curve

May 17, 2025

Japanese Government Bonds Navigating The Steep Yield Curve

May 17, 2025