Amundi Dow Jones Industrial Average UCITS ETF: NAV Explained And How It Impacts Your Investment

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

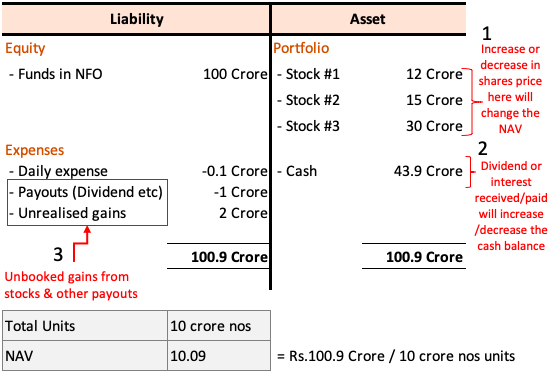

Net Asset Value (NAV) represents the net value of an ETF's assets. For the Amundi Dow Jones Industrial Average UCITS ETF, understanding its NAV is paramount to tracking your investment's performance. Simply put, NAV is the value of the ETF's holdings minus its liabilities, divided by the number of outstanding shares. The calculation is straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

For this specific ETF, determining the components is crucial.

- Assets: Primarily consist of the underlying securities mirroring the Dow Jones Industrial Average. This means the ETF holds shares in companies like Apple, Microsoft, and Johnson & Johnson, proportionally representing their weight in the index. The value of these holdings fluctuates daily based on market performance.

- Liabilities: Include management fees charged by Amundi, operational expenses, and any other outstanding debts. These are relatively smaller components compared to the asset value.

The NAV fluctuates daily because the market value of the underlying assets (the Dow Jones Industrial Average companies) changes constantly. Therefore, the ETF's NAV is recalculated each day, reflecting these market movements.

How Does NAV Affect the Amundi Dow Jones Industrial Average UCITS ETF's Price?

The Amundi Dow Jones Industrial Average UCITS ETF's price on the exchange should ideally closely track its NAV. However, market forces can lead to small premiums or discounts.

- Premiums: The ETF's market price trades slightly above its NAV due to high demand or short-term speculative trading.

- Discounts: The market price trades slightly below the NAV due to lower demand or market sentiment.

Several factors influence these deviations:

- Supply and Demand: High demand for the ETF can push its price above the NAV. Conversely, low demand can lead to a discount.

- Market Sentiment: Investor confidence and overall market conditions heavily impact the ETF's price. Positive sentiment can lead to premiums, while negative sentiment can result in discounts.

Monitoring the NAV allows investors to identify potential opportunities. A significant discount to NAV might indicate a buying opportunity, while a substantial premium could suggest a selling opportunity. However, remember trading costs and market liquidity play a crucial role in realizing these opportunities.

Understanding the Impact of NAV on Your Returns

Changes in the NAV directly translate to gains or losses for your investment. If the NAV increases, your investment grows, and vice-versa.

- Example: If you invest €10,000 and the NAV increases by 10%, your investment is worth €11,000 (excluding any trading fees). Conversely, a 5% decrease in NAV would reduce your investment to €9,500.

While short-term NAV volatility is normal, long-term growth is the key focus for most ETF investors. Regularly monitoring the NAV helps track the investment's performance over time. Consider rebalancing your portfolio based on the NAV performance and your overall investment strategy.

Amundi Dow Jones Industrial Average UCITS ETF: Investment Strategy Considerations

Investing in the Amundi Dow Jones Industrial Average UCITS ETF offers several benefits:

- Diversification: Exposure to 30 large-cap, blue-chip companies reduces individual stock risk.

- Index Tracking: Aims to mirror the performance of the Dow Jones Industrial Average, providing broad market exposure.

However, risks exist:

- Market Risk: The ETF's value is directly linked to the performance of the Dow Jones Industrial Average. Market downturns will impact the NAV and your investment.

- Macroeconomic Factors: Global economic events, political instability, and interest rate changes can significantly influence the ETF's performance.

Understanding the NAV is crucial for creating a robust investment strategy.

- Risk Tolerance: Assess your comfort level with market fluctuations before investing.

- Portfolio Diversification: Don't solely rely on this ETF. Diversify across asset classes and geographies.

- Regular Review: Periodically assess your investment strategy based on market conditions and your financial goals.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for informed investment decisions. By monitoring the NAV, its impact on the ETF price, and your returns, you can build a more effective investment strategy. Remember to factor in your risk tolerance and portfolio diversification. Start maximizing your investment potential with the Amundi Dow Jones Industrial Average UCITS ETF today by carefully analyzing its NAV and market performance. Learn more about how NAV impacts your investment in similar UCITS ETFs and further refine your approach.

Featured Posts

-

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025 -

Dax Performance Frankfurt Stock Market Opens Following Record Run

May 24, 2025

Dax Performance Frankfurt Stock Market Opens Following Record Run

May 24, 2025 -

Amundi Djia Ucits Etf Distribution Nav And Performance

May 24, 2025

Amundi Djia Ucits Etf Distribution Nav And Performance

May 24, 2025 -

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Latest Posts

-

Understanding Berkshire Hathaways Apple Strategy After Buffetts Departure

May 24, 2025

Understanding Berkshire Hathaways Apple Strategy After Buffetts Departure

May 24, 2025 -

The Future Of Berkshire Hathaways Apple Investment Under New Leadership

May 24, 2025

The Future Of Berkshire Hathaways Apple Investment Under New Leadership

May 24, 2025 -

Berkshire Hathaways Apple Stock Assessing The Impact Of Buffetts Succession

May 24, 2025

Berkshire Hathaways Apple Stock Assessing The Impact Of Buffetts Succession

May 24, 2025 -

Analyzing Berkshire Hathaways Apple Holdings Post Buffett Ceo Transition

May 24, 2025

Analyzing Berkshire Hathaways Apple Holdings Post Buffett Ceo Transition

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025